Bitcoin markets have been on a tear lately, and the price has spiked quite a bit last month and into November. However, as bitcoin’s value surpassed $7K per BTC, transaction bottleneck and miner fees have risen again, causing users to complain about unconfirmed transactions and paying $5-10 per transaction.

Also read: Ethereum Wallet Parity Hit by Second Critical Vulnerability – $150+ Million Frozen

Bitcoin Fees and Transaction Bottleneck On the Rise

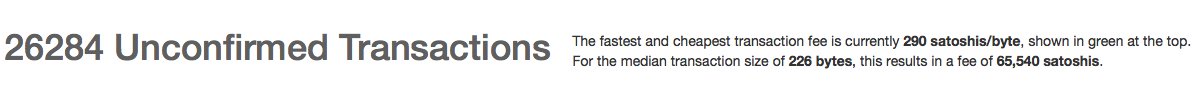

About two months ago the bitcoin network’s transaction congestion and rising fee market subsided for a couple of weeks. But lately, over the past three weeks transaction bottleneck and rising fees have started to plague the ecosystem once again. During this time, the network has seen the unconfirmed transaction count reach around 25-70K over the past few weeks. Presently there are 26,000 unconfirmed transactions (tx) in the mempool with about $42K in fees sitting in limbo.

At the moment the fastest and cheapest transaction fee is 65,540 satoshis or 4.50 per tx according to Earn’s fee calculator. Because the fee rate per BTC transaction is so high, those who own less than $4 worth of bitcoin can’t spend the funds without the chance of the tx being rejected from the network. Additionally, bitcoin has eight decimal places, and people are concerned that if the fee market continues to rise; small units of bitcoin will never be able to be spent or the fees will outweigh a transaction’s value.

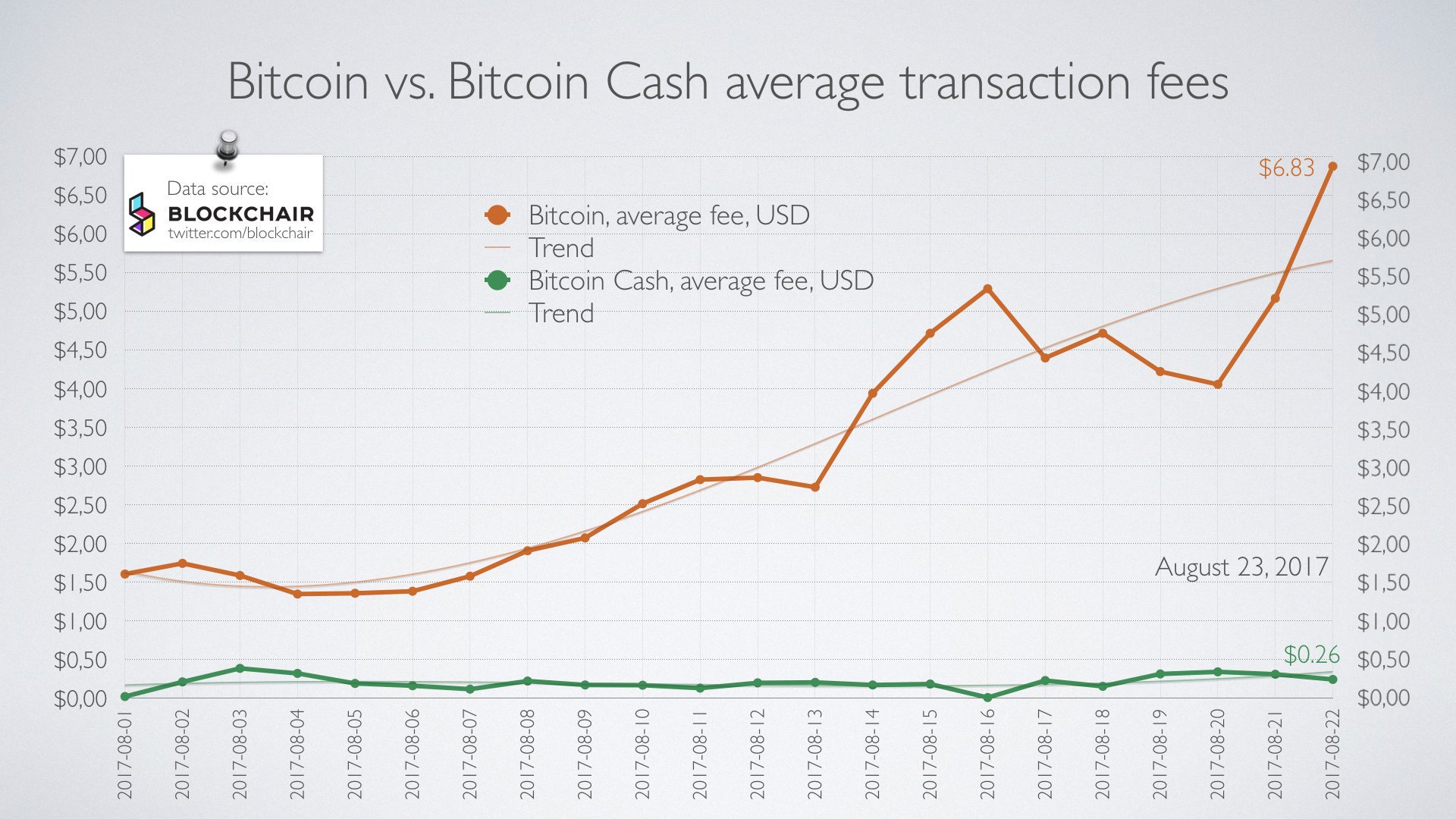

The Bitcoin Cash Network’s Fees Are Exponentially Lower

As bitcoin’s market value has increased and the fee market rising as well, many individuals are starting to see the benefits of the bitcoin cash network and larger blocks. Bitcoin cash transactions have been averaging $0.05-0.26 per tx or sometimes 1/10 of bitcoin’s fees. This has allowed the bitcoin cash community to send much smaller transactions and even use a tip-bot across Reddit forums.

Quarreling About Segwit Adoption In the Midst of the Pending Segwit2x Fork

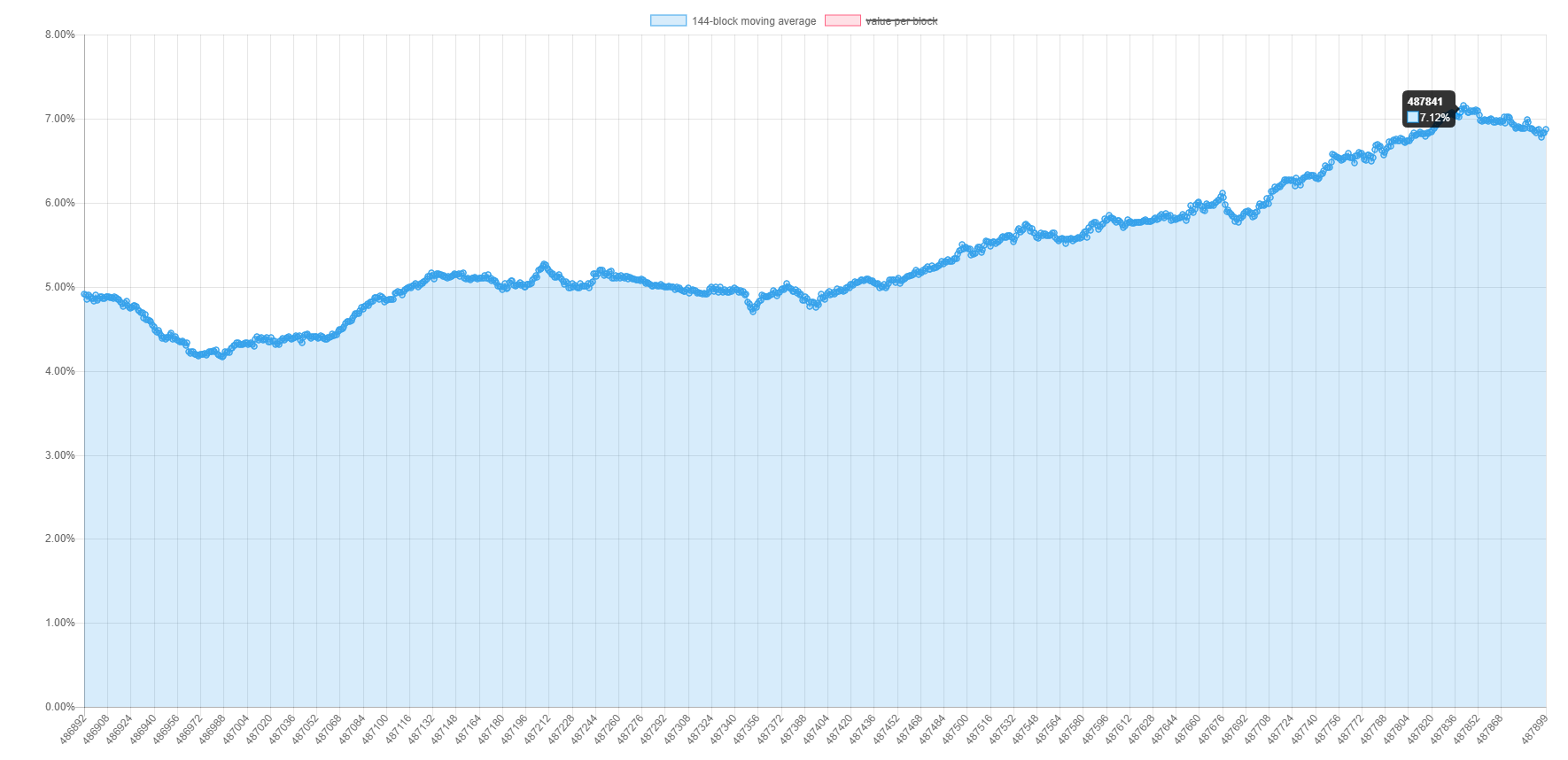

Another topic of conversation which revolves around the fee market is the use of Segregated Witness (Segwit) transactions. Before Segwit was implemented, it was said that 90 percent of bitcoin-based businesses were “Segwit ready.” Segwit adoption has yet to surpass 10 percent of the ecosystem, and Segwit transactions have seen a steep decline lately.

So far Segwit has seen adoption rates hit a high of roughly around 7 percent during the first weeks of October. The subject of Segwit adoption has genuinely become a bone of contention when discussing the recent astronomical fees lately. For instance on November 4, Shapeshift’s CEO Erik Voorhees reveals his discontent for the rising fee market plaguing the community stating;

The average Bitcoin transaction fee ($10.17) is now more than twice the cost of Bitcoin itself when I first learned of it ($5) in 2011.

Following Voorhees statement, over Twitter, the founder of Coinkite and Opendime, Rodolfo Novak, asked the Shapeshift CEO if his firm has “tried Segwit transactions.” However, the question didn’t sway Voorhees that much, as the Shapeshift founder emphasizes to Novak, “[Shapeshift] is one of the biggest senders and receivers of Segwit transactions.”

For now, no one has a good answer to how the bitcoin ‘community’ can find a solution to the scaling problem and rising fee market. At the moment, individuals and organizations continue to argue on social media and forums about the scaling subject, while preparing for the pending fork that aims to fix these problems.

What do you think about the recent Bitcoin network congestion and rising fees? Let us know what you think in the comments below.

Images via Shutterstock, Blockchain.info, Earn, Blockchair, and Pixabay.

At Bitcoin.com there’s a bunch of free helpful services. For instance, check out our Tools page!