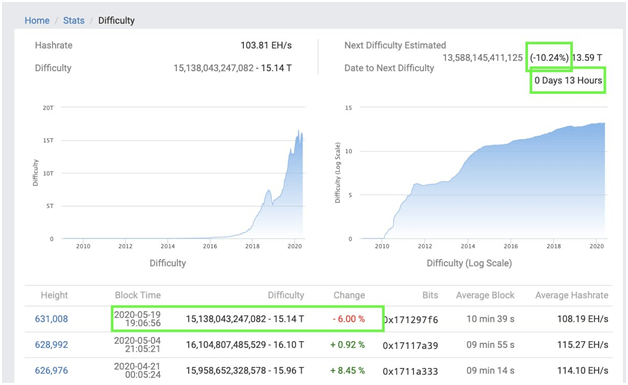

Historically, major decreases in mining difficulty have been followed by drops in Bitcoin’s price, as seen on May 20 when difficulty reduced by 6%

Bitcoin could have more room to fall as mining difficulty drops for the second time since the halving.

Bitcoin mining difficulty adjustments happen every 2016 blocks, or every two weeks, and determine how much effort is required by miners to confirm transactions before they are added to the blockchain.

Bitcoin’s difficulty level could decline by as much as 10.25% in today’s adjustment — potentially causing further tanking of Bitcoin’s price.

According to Sasha Fleyshman, a trader at investment firm Arca, today’s adjustment “would be the second straight downward adjustment in a row,” since the May 11 Bitcoin halving.

Short term correction

Historical charts show that wild swings in mining difficulty have always resulted in short term downtrends in the price of Bitcoin. It means that the top cryptocurrency is likely to drop in the coming days as miners find it easier to mine Bitcoin.

A decline in difficulty levels gives mining pools with the most advanced mining rigs the opportunity to increase their mining efficiency, pushing out miners with less efficient machines.

Such a case is known as capitulation and was responsible for a price plunge in December 2018 when levels dropped consecutively three times by 7.39%, 15.13% and 9.56%.

Bitcoin also declined from highs of $9,525 per bitcoin to lows of $8,650.

If big miners use their mining muscle to push those inefficient rigs off the network, a sell-off could ensue that miners look to cash in on their holdings. If that has already happened, then any moves on the descending channel may not result in very big drops.

The market is therefore likely to keep an eye on the next moves. As of press time, the price of the largest cryptocurrency by market cap continues to trade above $9,600 having declined from levels above $10k reached on Monday.

The post Another consecutive fall in mining difficulty could plummet Bitcoin’s price by 10% appeared first on Coin Journal.