A financial analyst looked closely at the spikes in Amazon’s stock price and bitcoin recently. While detailing similarities between the two investments, he explains why bitcoin may be one of the most lucrative trading opportunities for decades.

Also read: Most Popular Contactless Smart Cards in Japan Adding Bitcoin Hardware Wallets

Bitcoin is Most Lucrative

Education consultant and analyst Gordon Scott published an article on Wednesday explaining how “bitcoin looks a lot like an early Amazon,” referencing the massive spike in Amazon’s stock price that started in 1997. While citing bitcoin “holds real risks,” he believes “there is a real opportunity for traders right now”, adding that:

Bitcoin may be the most lucrative trading opportunity since internet stocks such as Amazon.com Inc. in the dot-com era.

Scott is the Managing Director of the Chartered Market Technician (CMT) program for the Market Technicians Association, a non-profit organization of professional technical analysts headquartered in New York City. Previously, he worked for IBM and TD Ameritrade and spent over 10 years as a trading coach and e-learning consultant.

Similarities to Amazon

After explaining the importance of blockchains and the tremendous impact they are likely to have on our society, Scott compared a few of bitcoin’s price spikes to that of the huge Amazon spike during the dot-com boom. He felt that the two spikes are similar because in each case investors are seeing a new technology that could change their world. “The latest run-up in the price of bitcoin is an indication that many more people are starting to believe these promises could actually be fulfilled,” Scott said.

After explaining the importance of blockchains and the tremendous impact they are likely to have on our society, Scott compared a few of bitcoin’s price spikes to that of the huge Amazon spike during the dot-com boom. He felt that the two spikes are similar because in each case investors are seeing a new technology that could change their world. “The latest run-up in the price of bitcoin is an indication that many more people are starting to believe these promises could actually be fulfilled,” Scott said.

Amazon went public in May 1997 at $18 per share in an initial public offering (IPO) which valued the company at around $438 million. Citing Amazon’s groundbreaking business model, Scott recalled that “investors were not able to fully and accurately quantify Amazon share value at first.” In 1997, people knew that Amazon had a great idea but they still could not fully give a proper valuation to its shares, he detailed, noting that “consequently, investors had to guess at the company’s value.”

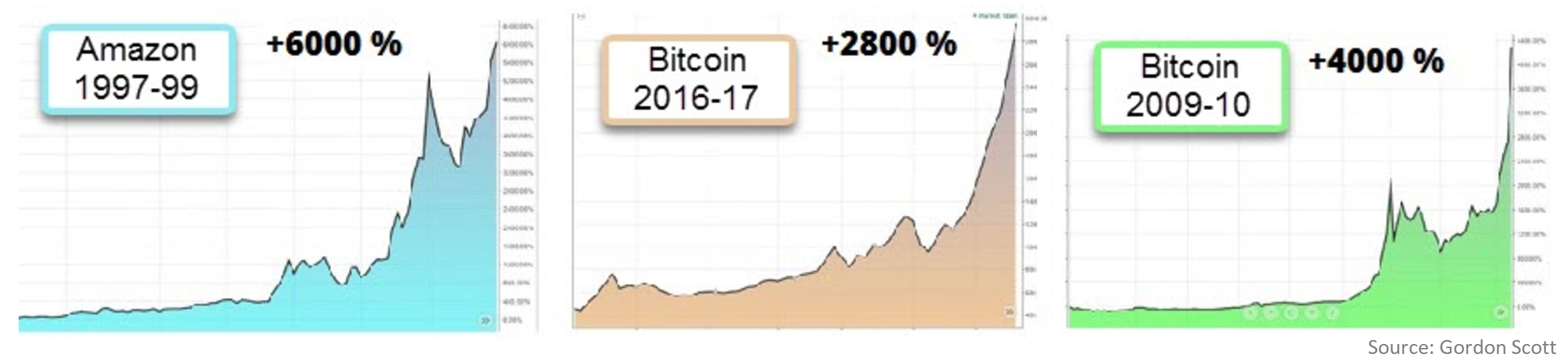

Scott compared the price of Amazon shares from 1997 to 1999 with bitcoin from 2016 to 2017 as well as from 2009 to 2010. The marketplace giant rose more than 6,000% in its first two years after its IPO, he described, noting that “18 years later the peak price from back then looks cheap by comparison today.”

While Amazon’s price surge is still larger than any single bitcoin price surge, Scott pointed out that it happened over a longer period of time than any one of bitcoin’s surges. “Surprisingly, bitcoin’s performance in its first two years only achieved two-thirds of Amazon’s original run-up,” he conveyed, then concluded:

It’s possible that cryptocurrencies are not only here to stay, but potentially a life changing mechanism for all of us. If that’s the case, then bitcoin offers investors a multi-decade investment opportunity, rising like Amazon’s market cap — and a price — that defies logic.

Do you think bitcoin will continue to be a great investment opportunity for decades? Let us know in the comments section below.

Images courtesy of Shutterstock, Gordon Scott, Investopedia, Microtrends

Need to calculate your bitcoin holdings? Check our tools section.