Ethereum

Ethereum is looking at several layers of resistance on multiple timeframes. It is time to exit that trade, in my opinion. Here is an example, on the 4 hour chart:

Other timeframes look equally scary. It seems to me that more aggressive traders will look for a short in this area. However, it is too scary to short a bull market like this one for me. I’ll leave that trade to others.

Bitcoin

Bitcoin is stuck in a sideways movement which does not have any obvious reason to advance until its siblings top out. It is above the top of the square, so it does not look like a fall is imminent. However, the shorter-term charts are not just sideways, they are flat.

While eth is looking likely to top out quite soon, others, such as Monero, are looking poised to move upwards next:

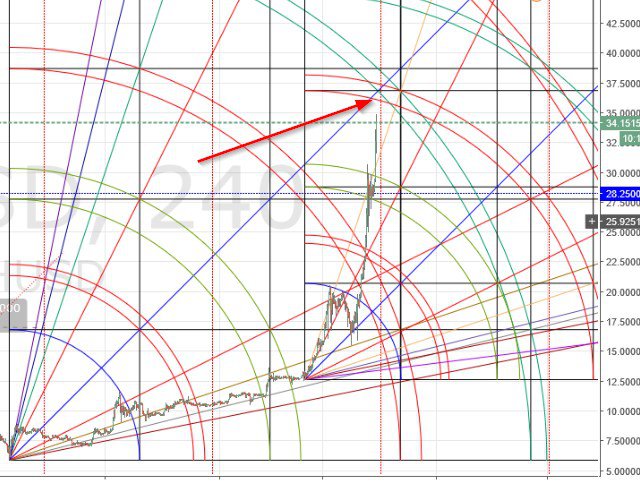

Monero

This chart looks delightful. Pricetime has only just crossed the 1st arc pair. The 3rd arc pair is a good first target at $26, but it would not surprise me at all if it went to the 5th pair, at ~$36

All in all, it appears that for now at least, the so-called ‘altcoins’ have taken center stage. Bitcoin may resume its run in the not-distant future, but for the time being, the money is rolling into several of the better-known of her siblings in the crypto space.

Bonds

US Treasury Bonds are arguably the most traded contract on the planet. With all the talk about interest rate hikes in the news, I decided to take a look at the chart to see what the reason was that such talk was in the air. As you can see, bonds are very near the 5th arc on a daily chart. Either the low is already in, or there is just one more push down remaining.

Happy trading!

Remember: The author is a trader who is subject to all manner of error in judgement. Do your own research, and be prepared to take full responsibility for your own trades.