Choppy markets have defined the crypto space since Bitcoin (BTC) sold off on April 19, and indecisive markets like these can test the patience and fortitude of even the most dedicated traders and analysts, especially when the incessant calls for a bottom are met with lower lows.

While the periods of low trading volume and whipsaw price movements may be the perfect conditions for whale-sized traders to play in, the average investor doesn’t stand a chance, especially with multimillion-dollar funds now beginning to get in on the action.

Data shows that instead of day trading and attempting to time the market bottom, dollar-cost averaging (DCA) is the best method for retail investors looking to build long-term profits in both traditional and crypto markets.

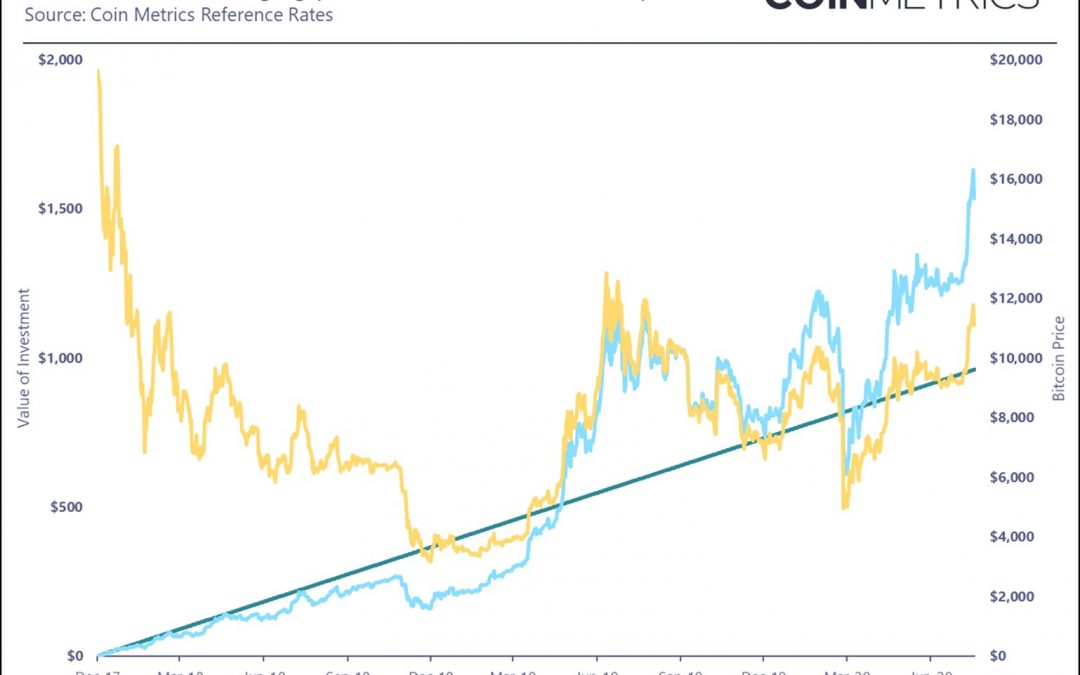

In 2020, Coin Metrics pointed out that investors who dollar-cost averaged into BTC starting from the December 2017 peak were still in profit three years later.

Coin Metrics tweeted:

“Despite #Bitcoin is still trading 30% below ATHs, dollar cost averaging from the peak of the market in Dec 2017 would have returned 61.8%, or 20.1% annually. Similarly for #Ethereum (still down 71% from its peak), dollar cost averaging from Jan 2018 would have returned 87.6%, or 27.9% annually.”

While the graph is a little dated now, one can see that over the long term, consistent investments spread over time have led to an overall increase in portfolio value.

Currently, with BTC down more than 47% from its all-time high of $64,863 and the cryptocurrency market continuing to send mixed signals, it may be an opportune moment to deploy the DCA strategy.

There’s more to investing than just “buying the dip”

Let’s take a look at the results of dollar-cost averaging into multiple cryptocurrencies from 2017–2018 through the end of June 2021.

The starting point for each analysis will be the day of the token’s 2017–2018 bull market all-time high value, and weekly investments of $10 will be applied from that point forward.

The peak for Bitcoin during the cycle came on Dec. 15, 2017, when BTC traded for $19,497, according to data from CoinMarketCap.

Using the DCA estimation tool provided by CostAVG.com, one can see that if $10 was invested in BTC on a daily basis from Dec. 15, 2017 until June 30, 2021, the total investment of $1,850 would have seen a 306% increase in value to be worth $7,519.

If one were to ask the opinions of most fund managers or traders who earn a living in the traditional investing world, a 306% increase in portfolio value over a four-year period is a spectacular rate of return.

Ether kicks back an outsized return

The price of Ether (ETH) exploded from late 2020 through early 2021 as the rise of decentralized finance (DeFi) and nonfungible tokens (NFT) exponentially increased the use of the Ethereum smart contract blockchain and boosted demand for ETH.

Increased demand helped ignite a rally that sent Ether’s price to $4,363 on May 12, 2021, but its price has since fallen nearly 50% to trade below $2,200 at the time of writing.

During the 2017 bull market, the price of ETH reached an all-time high of $1,396 on Jan. 12, 2018. Investors who used the DCA strategy, investing $10 per month starting at the peak, would have spent a total of $1,810 and generated a portfolio value of $15,507 at Ether’s current price. This represents an increase of 757%.

Related: Ethereum 2.0 approaches 6 million staked ETH milestone

The percentage gain for Ether is more than double what it would be for Bitcoin, giving some credence to those who have argued that Ether has been a better investment over the past couple of years.

Smaller-cap altcoins also benefit from the DCA strategy

To show the benefit of applying the DCA strategy to smaller-cap altcoins, let’s do a quick analysis of Theta, which has been one of the breakout stars of 2021.

THETA began a parabolic price climb in December 2020, with its price increasing from around $0.80 to $2.40 by Jan. 1, 2021. It then skyrocketed to an all-time high at $14.28 on April 15.

According to Blockchaincenter.net, which offers data for dollar-cost averaging a variety of tokens at a set investment of $10 per day, if an investor had begun investing in THETA on Jan. 1, 2018, the cumulative investment of $12,480 would now be worth more than $638,000 — a 5,000% increase.

While it’s obvious that not all altcoins performed as well as THETA during that time period, it’s a good example of how steady investing into a smaller-cap project can reward patient investors.

The benefit of dollar-cost averaging is that it removes emotion from the investment process and allows the investor to focus on other things, whereas day traders spend hours behind screens and often take on more losses than gains.

This also removes the need to search for market tops and bottoms and allows investors to gain exposure to a variety of assets in a measured, consistent manner.

No technique is perfect, and not every crypto project will make substantial gains or even survive until the next bull market cycle, but dollar-cost averaging is one approach that has provided consistent results for amateur and expert investors alike

Want more information about trading and investing in crypto markets?

- Altcoin Roundup: Post-crash prices give investors a chance to build a diversified portfolio

- Altcoin Roundup: Stablecoin pools could be the next frontier for DeFi

- Bitcoin heading for worst quarter since start of 2018 bear market

- Crypto market volatility peaks as Bitcoin and altcoins seek to recover

- Ethereum could go to $10K in 2021 and outperform Bitcoin, says veteran trader

Quotes in this newsletter taken from previously published sources have been lightly edited.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.