The long-awaited day finally came on Oct. 19 as the first Bitcoin (BTC) exchange-traded fund (ETF) went live on the New York Stock Exchange, thrusting the crypto asset into the limelight across mainstream news outlets and alternative media alike.

Despite the fact that the ETF in question will hold no actual Bitcoin and is instead a futures-based instrument, investors and pundits across the ecosystem have largely hailed its launch as proof that Bitcoin has hit the big leagues and will soon surpass the coveted $100,000 price target.

Many investors either don’t have access or will choose not to interact with the newly launched EFT, but holders can still use a variety of strategies to earn a yield on their BTC holdings.

Here’s a look at some strategies BTC holders can use to earn a yield.

DeFi meets BTC in BadgerDAO

BadgerDAO is an open-source protocol built on the Ethereum network that has the specific goal of building products and the required infrastructure needed to simplify the integration of Bitcoin into decentralized finance (DeFi).

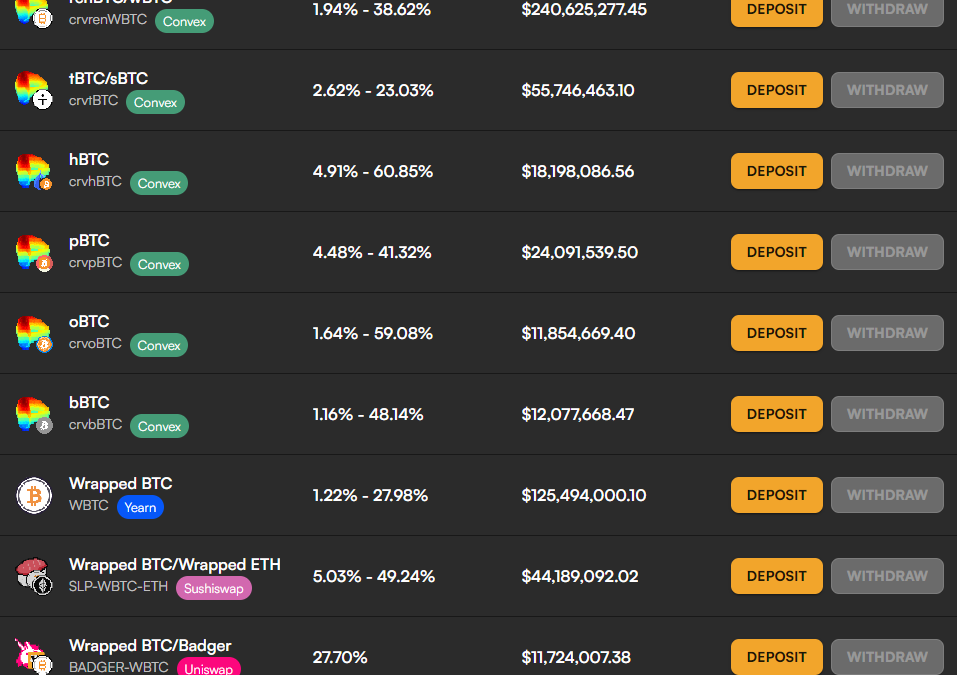

Currently, BadgerDAO has the most extensive list of BTC paired pools where investors can provide liquidity.

As seen in the image above from the BadgerDAO dashboard, there are different offerings from the simple staking of Wrapped BTC (wBTC), which can earn a yield ranging from 1.22% to 27.98% depending on the terms of the lockup, to the staking in more complex liquidity provider (LP) strategies like the renBTC/wBTC/sBTC pool, which offers a yield ranging from 7.07% to 45.37%.

It is important to note that there are risks involved with wrapping BTC and RenVM because a user must relinquish control of the original BTC in order to obtain either wBTC or renBTC, violating the crypto code of “not your keys, not your crypto.”

For LP tokens that pair BTC with other cryptocurrencies such as Ether (ETH), BADGER or stablecoins like Tether (USDT) and USD Coin (USDC), holders must also consider the possibility of suffering an impermanent loss if the price of Bitcoin increases by a significant amount compared to the other token it is paired with.

Trader Joe

Trader Joe is the largest decentralized trading platform by total value locked (TVL) on the Avalanche network, according to data from Defi Llama, with $2.18 billion worth of assets currently on the protocol.

Using wBTC on the Avalanche Network requires another layer of wrapping that produces wBTC.e, which can then be traded on the network or used to provide liquidity.

At the time of writing, Trader Joe is offering a yield on three LP tokens, including a return of 26.223% for the wBTC.e/AVAX pair, 16% for the wBTC.e/USDC.e pair, and 11.9% for the wBTC.e/USDT.e pair. All rewards are paid out in the protocol’s native JOE token.

Raydium

Raydium is the top-ranked DeFi protocol on the Solana network, according to data from Defi Llama, and currently boasts a TVL of $1.77 billion.

Users who wish to use their BTC on Solana have the option of pairing it with USDC, USDT, Serum (SRM) and a wrapped form of Solana known as mSOL.

The yields offered range from 5.16% to a high of 14.27%, with all rewards paid out in the platform’s native RAY token.

PancakeSwap

PancakeSwap is the No. 1 ranked protocol by TVL on the Binance Smart Chain (BSC) with data from Defi Llama showing that $5.39 billion worth of tokens is currently locked on the protocol.

In order to utilize Bitcoin on the BSC, it must first be wrapped to become BTCB, which can then transact on the network.

At present, PancakeSwap is offering a 5.44% return for the BTCB/ETH pair, a 15.82% return for the BTCB/BUSD pair (Binance’s stablecoin, Binance USD) and 20.79% for the BTCB/BNB pair. All rewards are paid out in the protocol’s native CAKE token.

Related: Valkyrie Bitcoin futures-linked ETF launches on Nasdaq, with share prices dropping 3% in first hour

Decentralized Bitcoin futures

DYdX is a decentralized perpetual futures trading platform that made waves back in September when it airdropped thousands of dollars worth of its native DYDX governance token to early adopters of the platform.

Similar to the ProShares Bitcoin Strategy ETF, trades made on the dYdX protocol do not settle in actual Bitcoin but instead in a USD stablecoin, so BTC stakers may not be too interested in the protocol if directly increasing Bitcoin holdings is the only goal.

However, as opposed to trading a government-regulated futures product that is only available when the traditional markets are open, dYdX offers the decentralized, 24/7 trading environment that the crypto faithful have grown to love.

Want more information about trading and investing in crypto markets?

- Bitcoin futures ETF debuts with highest-ever first day ‘natural’ volume of $1B

- ProShares Bitcoin-linked ETF launches on NYSE as BTC price rises above $63K

- Bitcoin-related altcoins surge as BTC ETF rumors spread across the sector

- Bitcoin briefly flippens Swiss franc after rally to new ATH

- Bitcoin futures ETF hits $1B AUM in a record-breaking two days

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.