Dozens of crypto funds, almost 70, have closed this year, a mainstream media outlet reported. And while the startling number reveals the influx of institutional investors into the crypto space might not be happening at a fast pace, it’s also worth noting that crypto fund launches are projected to reach 140 by the end of the year. That’s despite the prolonged 2018 crypto winter followed by an unstable recovery in 2019.

Also read: European Banks Struggle With Low Interest Rates and Strict Regulations

New Crypto Fund Launches Drop to Half the 2018 Number

The figure that caught Bloomberg’s attention refers to the closures of crypto-focused hedge funds mostly catering to pensions, family offices and wealthy individuals. North America (28) and Europe (23) account for the bulk of the 68 closures in the face of continuing market volatility and regulatory uncertainty. At the same time, the number of new funds launched this year is less than half that of 2018, the business news agency points out quoting data compiled by Crypto Fund Research, a California-based provider of market data and intelligence.

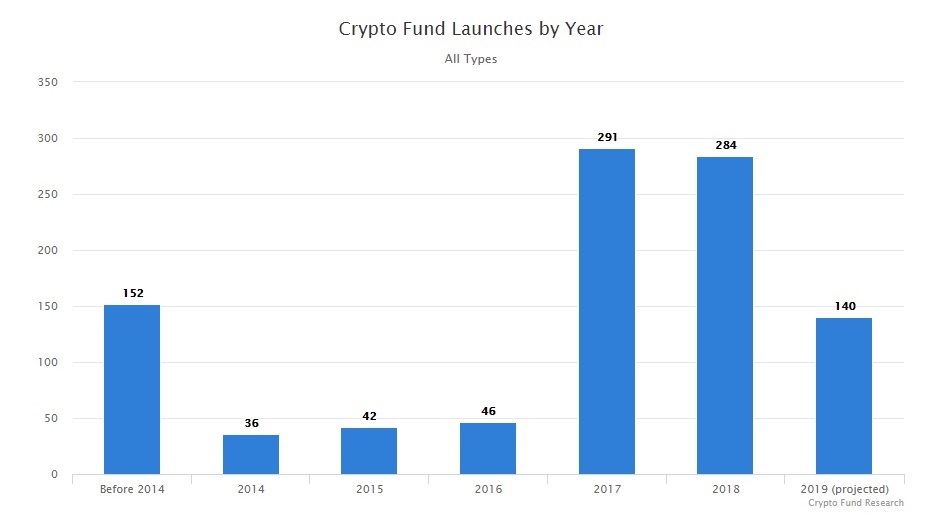

The platform’s analysis shows that the number of funds has been increasing in the long run, however. For example, 291 crypto funds, including hedge funds and venture capital, were launched in 2017, out of a total of around 700 hedge funds that year. The number increased with almost the same amount in 2018, which saw 284 crypto fund launches. For comparison, only 152 were established before 2014 and then the following three years saw between 36 and 46 launches annually.

Although most crypto investment funds are small, with half of them managing less than $10 million worth of assets, there are almost 60 funds with over $100 million in assets and the same number of funds have more than 25 employees. These include funds such as Pantera Capital, Galaxy Digital Assets, Alhpabit Fund, and Polychain Capital.

Total Assets Under Crypto Fund Management Grows

According to Crypto Fund Research, the total amount of assets managed by crypto funds has increased last year, despite the falling market prices. The long term trend is positive with the value of crypto assets under management increasing from $190 million in early 2016 to over $19 billion as of October 2019. The market intelligence platform concludes that the crypto fund industry has been growing rapidly in the past few years. Despite the sharp fall of crypto prices during last year, the growth of new funds and fund inflows contributed to the rising total of managed assets in the sector.

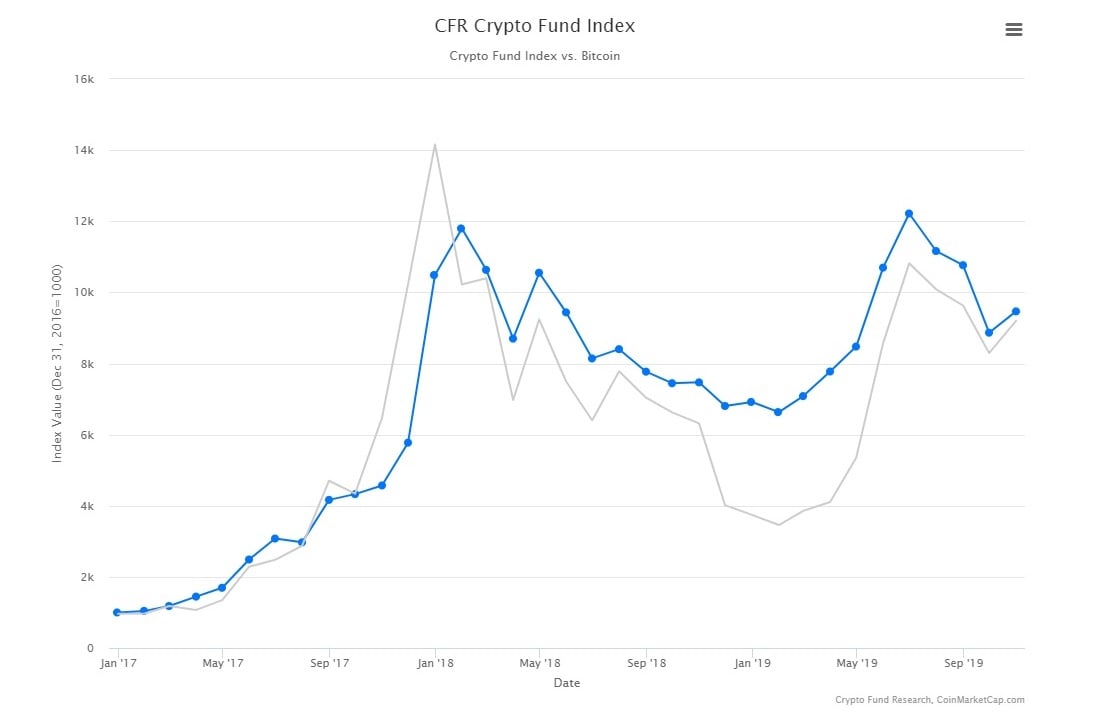

The volume of assets managed by these entities depends on several key factors such as the establishment of new funds, net inflows to existing funds and changes in the value of portfolio assets. The Cryptocurrency Fund Index, calculated by Crypto Fund Research using data from 50 funds, shows that in terms of growth crypto funds have generally outperformed leading cryptocurrencies since 2016 with the exception of periods with bull markets.

There are currently 804 cryptocurrency and blockchain funds, 355 crypto hedge funds and 425 crypto venture capital funds, according to the San Francisco-headquartered company. Almost 400 crypto funds are based in the United States, followed by Hong Kong with 84, the United Kingdom, 55, and Switzerland with 26. San Francisco is the city that hosts the largest number of funds, 79, New York is second with 74 and the other global financial capital, London, comes in third place with 49.

What are your expectations about the development of the crypto fund industry in 2020? Share your thoughts in the comments section below.

Images courtesy of Shutterstock, Crypto Fund Research.

Did you know you can buy and sell BCH privately using our noncustodial, peer-to-peer Local Bitcoin Cash trading platform? The Local.Bitcoin.com marketplace has thousands of participants from all around the world trading BCH right now. And if you need a bitcoin wallet to securely store your coins, you can download one from us here.

The post Almost 70 Crypto Funds Close This Year, Twice as Many Launch appeared first on Bitcoin News.