The GDAX exchange, owned and operated by the firm Coinbase has just announced integration with the popular algorithmic trading platform Quantconnect. Now cryptocurrency traders can utilize Quantconnect’s trading algorithm interface to execute a swathe of exchange strategies.

Also read: An Introduction to Bitcoin Trading and Technical Charts

Identify, Backtest and Research New Quants With GDAX and Quantconnect

Algorithmic trading has been used within trading exchanges since the seventies by using computers to follow the flow of financial markets. The method allows the execution of orders that are automated, and pre-programmed to adjust with price variables, time, and trade volumes. Algorithmic trading is used by cryptocurrency traders already as there is a slew of companies that offer automated services and open source trading bots. The New York-based firm Quantconnect has been a well known algorithmic trading service since being found in 2011 by the entrepreneur Jared Broad.

Algorithmic trading has been used within trading exchanges since the seventies by using computers to follow the flow of financial markets. The method allows the execution of orders that are automated, and pre-programmed to adjust with price variables, time, and trade volumes. Algorithmic trading is used by cryptocurrency traders already as there is a slew of companies that offer automated services and open source trading bots. The New York-based firm Quantconnect has been a well known algorithmic trading service since being found in 2011 by the entrepreneur Jared Broad.

“Through an integration with GDAX, Quantconnect’s technology has been extended to include cryptocurrency assets,” explains the firm’s announcement.

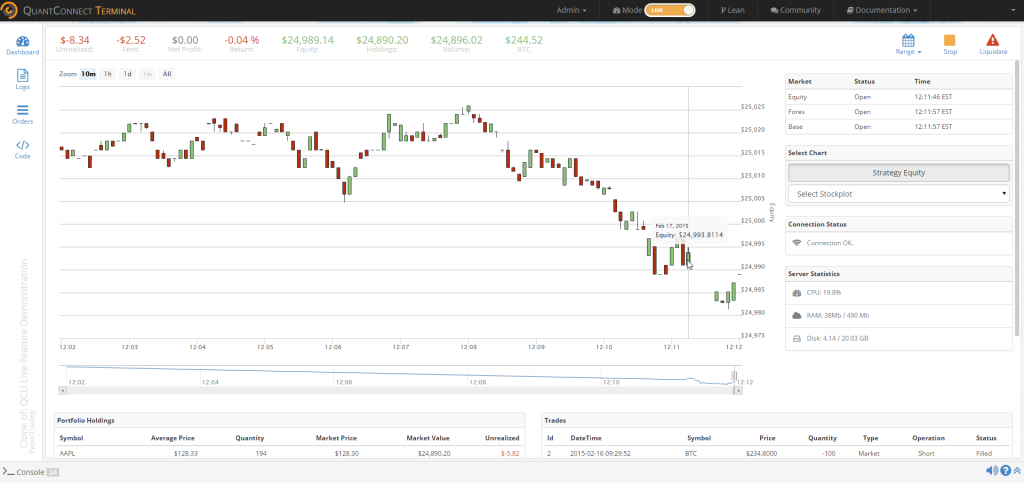

Adding cryptocurrencies to the platform allows users to identify, backtest and research new ideas, insights, and strategies, Additionally, users will have the opportunity to hedge preexisting positions by investing in cryptocurrency.

Designing and Instantly Deploying Cryptocurrency Strategies

This year Quantconnect has seen a lot of growth as traders are becoming more attracted to live algorithmic trading. The firm says both strategy building and backtesting activity is up over 300 percent and new live algorithms have increased by 30 percent.

“Adding cryptocurrency support to Quantconnect was the next logical step for our business,” explains the Quantconnect founder, Jared Broad. “As a powerful open-source initiative, we saw an opportunity to reach a larger set of quants and engineers that have been investing in digital currencies. Now, with a strategic integration with GDAX, the Quantconnect community can design and instantly deploy cryptocurrency strategies.”

Traditional Financial Institutions Are Focusing On Cryptocurrencies

The GDAX president, Adam White, says the latest integration with Quantconnect shows conventional financial institutions are continuing to evolve towards cryptocurrencies. “As the awareness of digital currency as an emerging asset class grows, Quantconnect has made it easier for institutions to conveniently backtest, research and live trade digital currencies,” details the Coinbase and GDAX senior executive.

The GDAX president, Adam White, says the latest integration with Quantconnect shows conventional financial institutions are continuing to evolve towards cryptocurrencies. “As the awareness of digital currency as an emerging asset class grows, Quantconnect has made it easier for institutions to conveniently backtest, research and live trade digital currencies,” details the Coinbase and GDAX senior executive.

As bitcoin and cryptocurrencies continue to grow popular the use of algorithmic trading has also increased within the emerging economy. Services like Haasbot, BTC Robot, and Cryptotrader also offer similar automated trading platforms and pre-programmed trading bots. Quantconnect also reveals the platform will soon be integrated with the San Francisco-based Kraken exchange as well.

What do you think about Quantconnect integrating with GDAX and Kraken? Do you use automated trading platforms or bots? Let us know in the comments below.

Images via Shutterstock, Quantconnect, and GDAX.

Need to calculate your bitcoin holdings? Check our tools section.