Researchers at the American Institute for Economic Research (AIER) teamed with Missouri University to examine whether the price of bitcoin is being manipulated by a few traders. Conspiracy theories abound, and new accusations arise regularly. A first in a series of papers on the world’s most popular cryptocurrency, the present project attempts to show a connection to major price spikes and newsworthy events.

Also read: Tezos Swiss Foundation Concept is “Old, Inflexible and Stupid”

AIER Dampens Price Conspiratorialists

“While the nature of the news events does not necessarily explain the magnitude of Bitcoin’s price changes or its daily volatility,” concludes Bitcoin’s Largest Price Changes Coincide With Major News Events About the Cryptocurrency, a research brief published at AIER by Senior Research Fellow Max Gulker, “it does suggest that the market is not being driven entirely by manipulation or the behavior of small numbers of traders.”

The American Institute for Economic Research is more on the ecosystem’s radar these days in large part to a recent change in management. Popular market economist Edward Stringham took a position as President, Director of Research and Education, and promptly brought over Jeffrey Tucker from the Foundation for Economic Education. Both Mr. Stringham and Mr. Tucker are well known bitcoin enthusiasts, and Mr. Tucker was widely considered to have given the most stirring talk at this year’s North American Bitcoin Conference in Miami.

The brief concedes immediately bitcoin might not yet be subject to efficient market theory. Its price in such a scenario “should reflect all publicly available information about it, and changes in price should reflect new information.” Bitcoin, though it has grown in volume and interest, is still a relatively small market, all things considered. This makes markets like it especially susceptible to manipulation by a cabals, what the paper refers to as “the idiosyncratic behavior of a few individuals.”

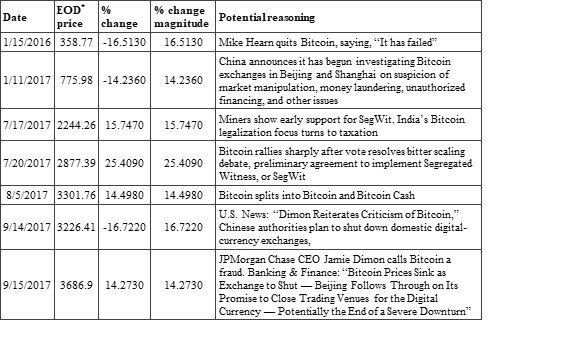

The paper takes into account nearly two years of bitcoin price activity: all of 2016 through November of the following year, focusing “on the largest daily changes in price.” Important caveats follow. There is movement in the price where “significant or widely discussed new information about the cryptocurrency was revealed.” Again, that doesn’t mean necessarily bitcoin’s market price is efficient nor rational, but it seems to lean in that direction. Researchers are careful to stress they cannot “establish certain causality between the events and price changes in question.”

Reliable News is Important

Take for example corporate tax bailout recipient and quotable blowhard Jamie Dimon of JP Morgan Chase. His comments in late September of last year seemed to have shocked weaker hands in the bitcoin market some thirty odd percent over two days (see first inset). Prior to those two day dips, the price hadn’t plunged that much since the year’s beginning. “However,” the brief suggests, “the fact that one can point to specific events coinciding with the largest changes in price suggests at least some degree of rationality in the market.”

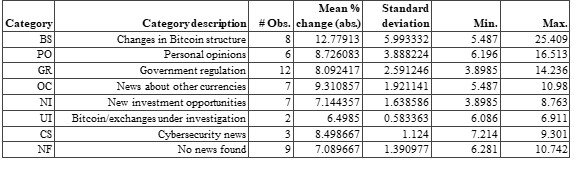

Arguably the most compelling finding came from their examination of fifty huge price swings (see second chart). “We categorized potential news events into eight categories: BS (change in structure of Bitcoin), PO (personal opinions), GR (government regulation), OC (other currencies), NI (new investment opportunities), UI (under investigation), CS (cybersecurity), and NF (nothing found).”

Within those categories, “we found that news about changes in the structure of Bitcoin (such as scaling and potential forks) had the largest effect on the price,” they explain. Whatever the case, perhaps the import of this preliminary study is to monitor bitcoin news carefully, and to choose reliable sources of that information.

Do you believe bitcoin’s price is being manipulated? Let us know in the comments section below.

Images courtesy of Pixabay, AIER.

Not up to date on the news? Listen to This Week in Bitcoin, a podcast updated each Friday.

The post AIER Researchers: Bitcoin’s Price Moves with News appeared first on Bitcoin News.