Bitcoin’s latest rally to a new all-time high price above $66,000 has given rise to a fresh wave of bullish predictions, with the cryptocurrency’s price already more than double where it started the year.

“Bitcoin breaking its all-time high was a long time coming and had been in the making ever since the asset shed 50% of its value in May,” Ben Caselin, head of research and strategy for the crypto exchange AAX, told CoinDesk in an interview.

He now expects the price to rocket past the $100,000 mark, which a growing number of market analysts are penciling in as their new price target.

The Bitcoin blockchain is just 12 years old, and traders in both digital markets and Wall Street are arguably more focused than ever before on the cryptocurrency’s movements. So with the price now at unprecedented levels, analysts are adjusting their models and scrutinizing charts to predict what comes next.

Just this month alone, the bitcoin price has rallied more than 50%, fueled by U.S. regulators’ first approvals of exchange-traded funds (ETFs) linked to bitcoin futures contract. The ProShares Bitcoin Strategy ETF launched Tuesday on the New York Stock Exchange and hauled in some $570 million of assets on its first day, while garnering an astounding $1 billion in trading volume, in one of the most successful ETF launches of all time.

The market’s previous all-time high was $64,889 in April. Since then, market prognosticators saw that mark as the price to beat. Now, with fewer readily available signposts, the outlook might be harder to gauge.

What the charts are saying

CoinDesk’s Damanick Dantes wrote Wednesday that $86,000 might represent the next key price target for bulls, based on a reading of price-chart signals.

“All eyes are set on the $100K mark, but when retail does rush in and more funds open up to bitcoin, including physically backed ETFs, $100K is unlikely to be the end of it,” Caselin said.

CoinDesk reached out to top market analysts for their insight. Here’s where they see the market headed.

Quick tease: Not everyone is bullish. Some analysts say bitcoin will stay find further gains past the $60,000 mark tougher to come by.

Bullish

- Matthew Dibb, COO of Stack Funds: Since the successful launch of ProShares’ ETF last night, there has been a large influx of retail participation. Funding rates for the futures market – a gauge of how willing investors are to pay up for leveraged bets – are rising, but not at the high levels seen earlier in the year. ”Our next target on spot BTC is $80,000 in the short term,” said Dibb. As the market gains further confidence in the medium term, he said, some capital rotation is to be expected from bitcoin into ether, the native cryptocurrency of the Ethereum blockchain, and other alternative digital assets.

- Ulrik Lykke, founder of ARK36: “I wouldn’t be surprised if we see bitcoin climb towards $100,000 during Q4 of 2021 or Q1 of 2022.”

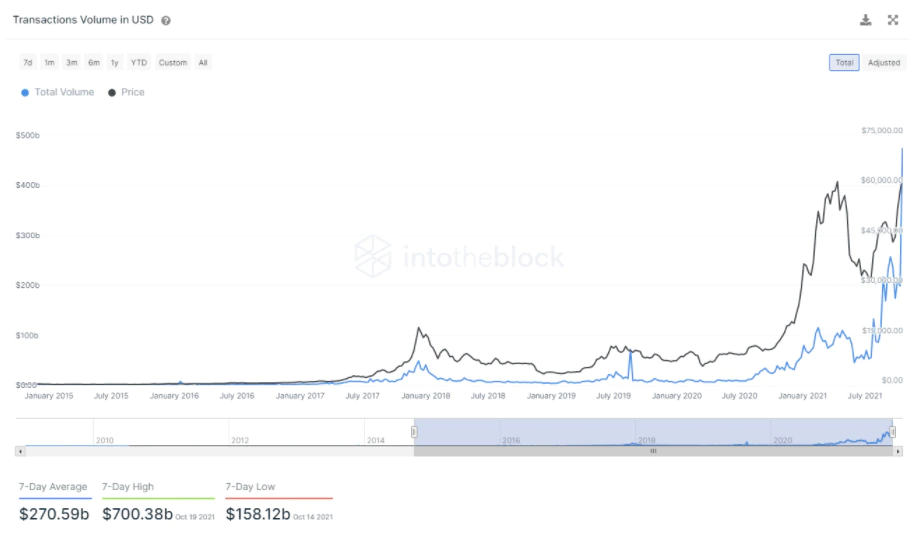

- Juan Pellicer, research analyst at IntoTheBlock: “This growth is a phenomenal proxy of the institutional clients that have been adopting bitcoin.”

Bearish

- Samuel Indyk, analyst at Investing.com: As has been the case in the past when major events in the cryptocurrency space occur, a correction could be on the cards: “For example, when the bitcoin futures contract launched on the Chicago Mercantile Exchange (CME) in 2017, a bear market occurred shortly after, and it took almost three years for the price to recover.”

What else analysts are saying

One risk is that soaring oil and natural gas prices might lead to extra scrutiny over the Bitcoin network’s energy usage, according to Edward Moya, senior market analyst at Oanda. That’s especially the case as winter approaches in the Northern Hemisphere.

“Governments might take harsh stances if this winter leads to shortfalls in energy across several countries and that could mess with the hash rate,” warned Moya. Hash rate is a gauge of the number of computations sent every second to the Bitcoin network to confirm new data blocks and transactions.