Bitcoin cash and litecoin futures might be coming to Cboe as soon as this year. The Gemini exchange, which supplies the data feed for the trading venues’ recently launched bitcoin futures, has as its top priority for 2018 adding support for trading new currencies, starting with two of the top five coins by market cap.

Also Read: Chinese Internet Regulators Block Cryptocurrency Exchanges on Social Media

BCH and LTC on Gemini

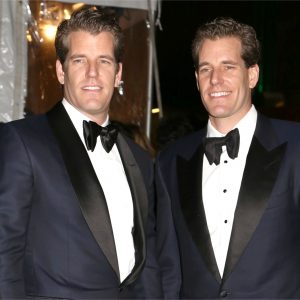

The founders of the New York licensed digital asset trading venue Gemini Exchange, Tyler and Cameron Winklevoss, have revealed that adding new cryptocurrency options are high on the company’s agenda this year with bitcoin cash and litecoin at the top of the list. The exchange already offers bitcoin (BTC) and ethereum (ETH) and by listing BCH and LTC pairs it will cover four out of the five top cryptocurrencies by total market cap with only Ripple’s XRP excluded.

The founders of the New York licensed digital asset trading venue Gemini Exchange, Tyler and Cameron Winklevoss, have revealed that adding new cryptocurrency options are high on the company’s agenda this year with bitcoin cash and litecoin at the top of the list. The exchange already offers bitcoin (BTC) and ethereum (ETH) and by listing BCH and LTC pairs it will cover four out of the five top cryptocurrencies by total market cap with only Ripple’s XRP excluded.

Beyond Gemini’s direct clients, the inclusion of new cryptocurrencies can have much wider effects on crypto derivatives trading as well. The bitcoin futures contracts launched in December 2017 by Cboe Global Markets (Nasdaq: CBOE) is based on the Gemini exchange’s auction price for BTC, denominated in U.S. dollars. With new BCH and LTC data feeds available from Gemini, Cboe will be able to expand the crypto instruments and offer a more diversified exposure to its traditional clients.

Speaking Thursday at a Cboe event in Florida, the Gemini operators said that the licensing agreement with Cboe is scalable, and they entered into the deal knowing it could expand in terms of offerings. Obvious candidates for expansion “are from the Satoshi Nakamoto family tree: Bitcoin cash, Litecoin,” Tyler Winklevoss explained.

Not Worried About Price Drop, Applaud SEC

Besides focusing on adding bitcoin cash and litecoin, the Gemini founders also recntly commented on other highly discussed topics in the crypto community.

Besides focusing on adding bitcoin cash and litecoin, the Gemini founders also recntly commented on other highly discussed topics in the crypto community.

They said they aren’t concerned about the sharp price drops or the slowdown in volume, because they followed bitcoin since it was worth just $8 and short term drops happened many times before but they are in it for the long-term. “In 2018, you’re really going to see institutions and Wall Street really get in, and it’s going to look very different,” Tyler Winklevoss predicted.

The Gemini founders even said they “applaud” the SEC announcement from Wednesday that many link with the price drop. The agency warned that exchanges that offer what it considers to be securities without a license are operating unlawfully.

What cryptocurrencies do you think should be available for futures trading next? Share your thoughts in the comments section below!

Images courtesy of Shutterstock.

Do you like to research and read about Bitcoin technology? Check out Bitcoin.com’s Wiki page for an in-depth look at Bitcoin’s innovative technology and interesting history.

The post Adding Bitcoin Cash and Litecoin Is Main Goal of 2018 for Gemini Exchange appeared first on Bitcoin News.