ACCOUNTING.com is a one-stop platform that allows cryptocurrency users to track their crypto portfolios and file their crypto taxes. It was founded in 2018 and is headquartered in Switzerland.

It has a desktop platform and a mobile app; both of which have a user interface that features that has an insightful dashboard to help users track the performance of their decentralized finance (DeFi), centralized finance (CeFi), and non-fungible token (NFT) transactions in real-time.

It helps users to easily categorize their trades and transactions for the purposes of filing taxes in their respective countries or regions.

Here is a must-read review of ACCOUNTING.com highlighting how it works, its key features, its pros and cons, and why you should use it.

How it works

ACCOUNTING.com offers a set of tools to help with the following tasks:

- Crypto portfolio tracking including market overview, market lists, market alerts, and market sentiments

- Crypto portfolio management including asset allocation and historical portfolio performance.

- Creating tax reports including custom tax reports, tax software integration, and tax forms (e.g. Turbo tax, Form 8949, and WisoSteauer), and tax optimization (Trading Tax Optimizer-Tax Loss Harvesting).

ACCOUNTING.com has integrated with over 400+ crypto service providers including crypto wallets, exchanges, and DeFi protocols, to allow you to automatically import your transactions from your crypto wallets and exchanges for purposes of calculating your gains and losses. It also lets you do a real-time analysis of your performance and deep-dive into your transaction history across the cryptoverse.

In addition, ACCOUNTING.com enables you to get your crypto tax reports in only 5 clicks. You can get the reports in FIFO, LIFO, and HIFO formats.

You can also review the performance of the general crypto market, set up alerts, research trending tokens, and share the personalized and curated token list via Twitter.

Key features

Crypto APIs

ACCOUNTING.com has over 400+ integrations with crypto exchanges, wallets, blockchains, and other crypto service providers to help users import transactions from other crypto platforms.

Some of the exchanges that it has integrated with are Binance, OKX, FTX, BitPanda, FTX, Coin Spot, Kraken, Gemini, Poloniex, and Kucoin.

Crypto portfolio management

ACCOINTING.com has a crypto portfolio dashboard on its desktop, iOS, and Android platforms that allows users to automatically connect to all their crypto exchanges and wallets to see a summary of their trades, and net profit.

Crypto tax calculator

This allows users to automatically classify and calculate their crypto taxes. It allows users to take account of all crypto activities including DeFi staking, margin trading, mining, and trading. The calculator applies the generally accepted crypto tax principles in generating crypto tax reports.

Besides helping in crypto tax reporting, the crypto tax calculator also helps in identifying possible tax-saving opportunities.

ACCOUNTING.com pricing

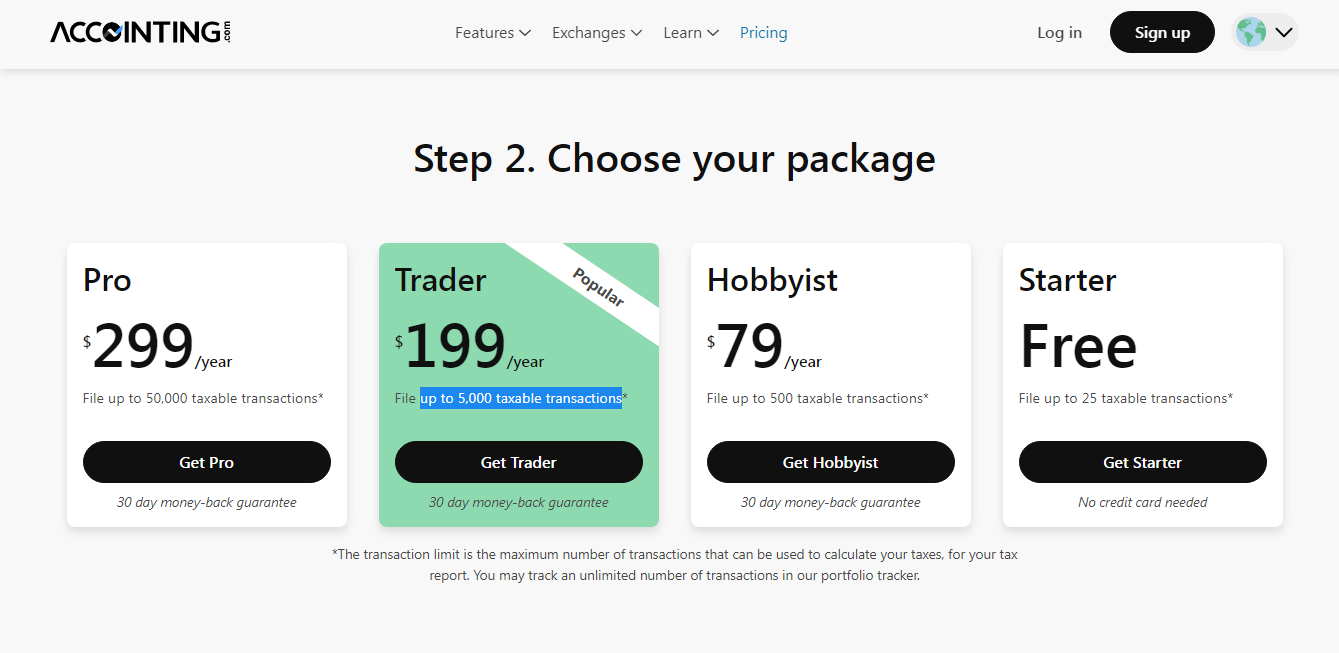

ACCOUNTING.com has four packages: the starter, Hobbyist, Trader, and Pro.

- Starter package – This is free and it allows users to file up to 25 taxable transactions per year. If you do not do too many crypto transactions, then this is a good package for you.

- Hobbyist package – This allows users to file reports for up to 500 taxable transactions per year. It costs $75 per year.

- Trader package –This allows users to file reports for up to 5,000 taxable transactions per year. It costs $199 per year.

- Pro package – This allows users to file reports for up to 50,000 taxable transactions per year. It costs $299 per year.

Pros and Cons of ACCOINTING.com

Pros

- ACCOUNTING.com allows users to easily connect to wallets and crypto exchanges and track their crypto portfolio from a single platform.

- It allows users to easily classify crypto transactions and generate crypto tax reports.

- It only takes about 5 clicks to generate the crypto tax reports.

- It also includes NFT transactions when generating the tax reports.

- It allows users to edit any transaction details to ensure that the tax reports are accurate

Cons

- At times, especially when the crypto transactions are too many, the transaction details can be a bit confusing.

- It also needs further integrations to include wallets like Trust wallet, which is a very popular crypto wallet.

Why should you use ACCOINTING.com?

Filing crypto taxes can be quite challenging especially when you are involved in too many transactions including NFTs. The hardest part is classifying the crypto transactions to determine what type of tax to pay and it becomes even harder when you are transacting or trading different crypto products.

ACCOUNTING.com provides a one-stop platform where you can generate crypto tax reports for filing your crypto taxes. You can select the package to use depending on the number of transactions you have made in the year under consideration.

Once you sign up and pay for your package of choice it only takes about 5 clicks to automatically generate crypto tax reports. It saves you the agony of manually classifying and calculating how much tax you should pay.

Besides, they have outstanding customer services, best-in-class accuracy when generating the tax reports, and offer detailed explanatory guides to help newcomers understand how to go about the process of filing their crypto taxes.

Final verdict

ACCOUNTING.com is a game changer in filling crypto taxes for individual crypto users and organizations. It does not discriminate against individuals from companies. Mid-Size businesses, small businesses, enterprises, individual freelancers, crypto whales, nonprofit organizations, and governments choose from the same packages depending on the number of crypto transactions in consideration.

It is a great choice when looking for a platform to generate crypto tax reports since you can link to any crypto service provider. It has integrated almost all crypto exchanges and wallets. Some of the exchanges and wallets that ACCOUNTING.com has not integrated are because they do not have APIs.

The post ACCOINTING.com review: track crypto portfolios and generate crypto tax reports appeared first on CoinJournal.