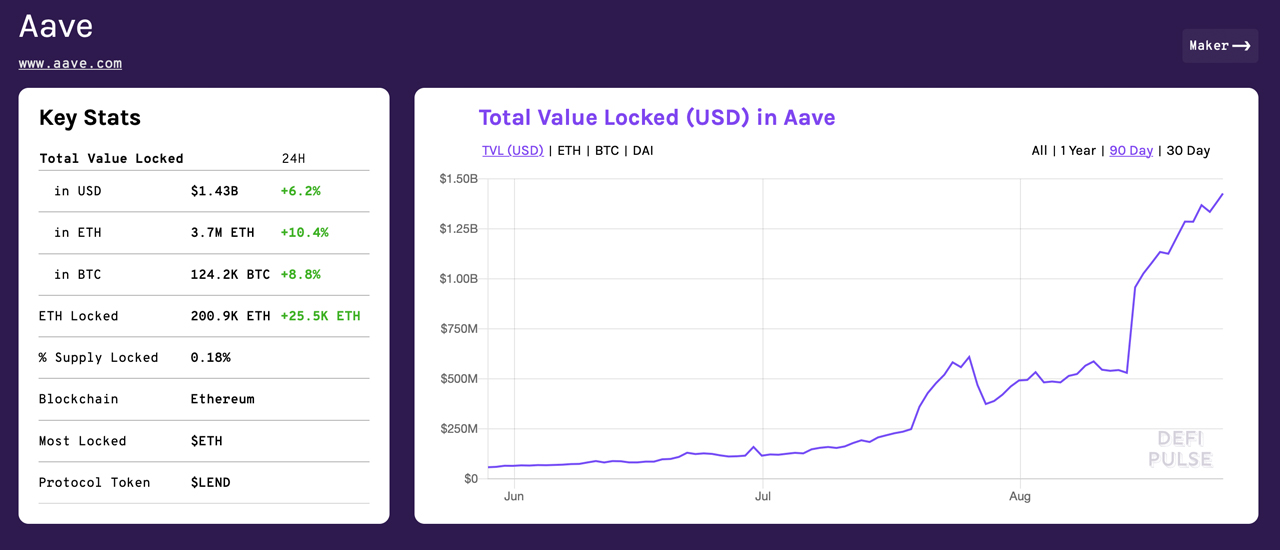

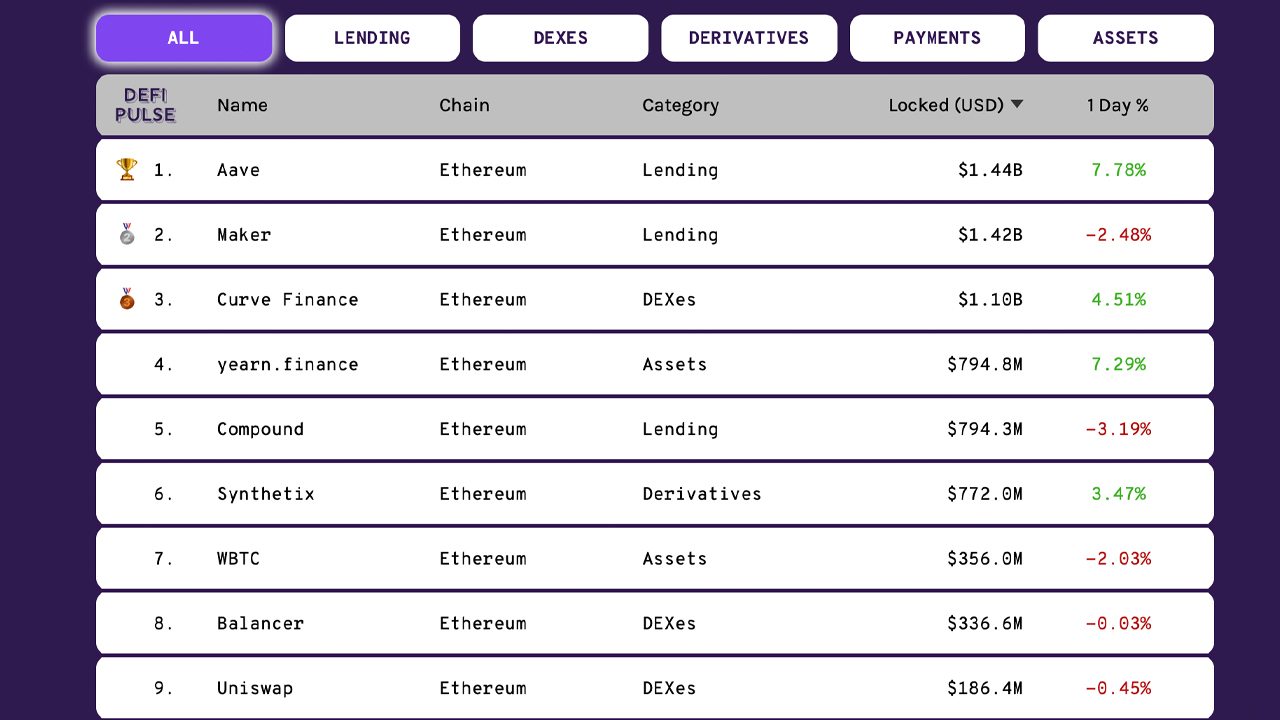

The decentralized finance (defi) open-source protocol built on Ethereum, Aave, has surpassed the Maker Dao project in terms of total-value-locked (TVL) this week. The lending and borrowing platform Aave has $1.43 billion locked on Tuesday climbing 7.7% in the last 24-hours.

On August 25, the defi project Aave (the Finnish word for ‘ghost’) has seen it’s TVL supersede the Maker Dao project. Essentially Aave is an open-source, noncustodial protocol that has allowed individuals to stake credit lines by leveraging a myriad of digital assets.

After the first month of launch, Aave’s protocol TVL had over $5 million in liquidity locked and it jumped 28,500% since then. At the time of publication, Aave is the top defi application on the website defipulse.com representing $1.43 billion locked into the protocol.

Maker Dao holds around $1.42 billion on Tuesday, as the lending protocol Maker is usually the top defi app in terms of TVL.

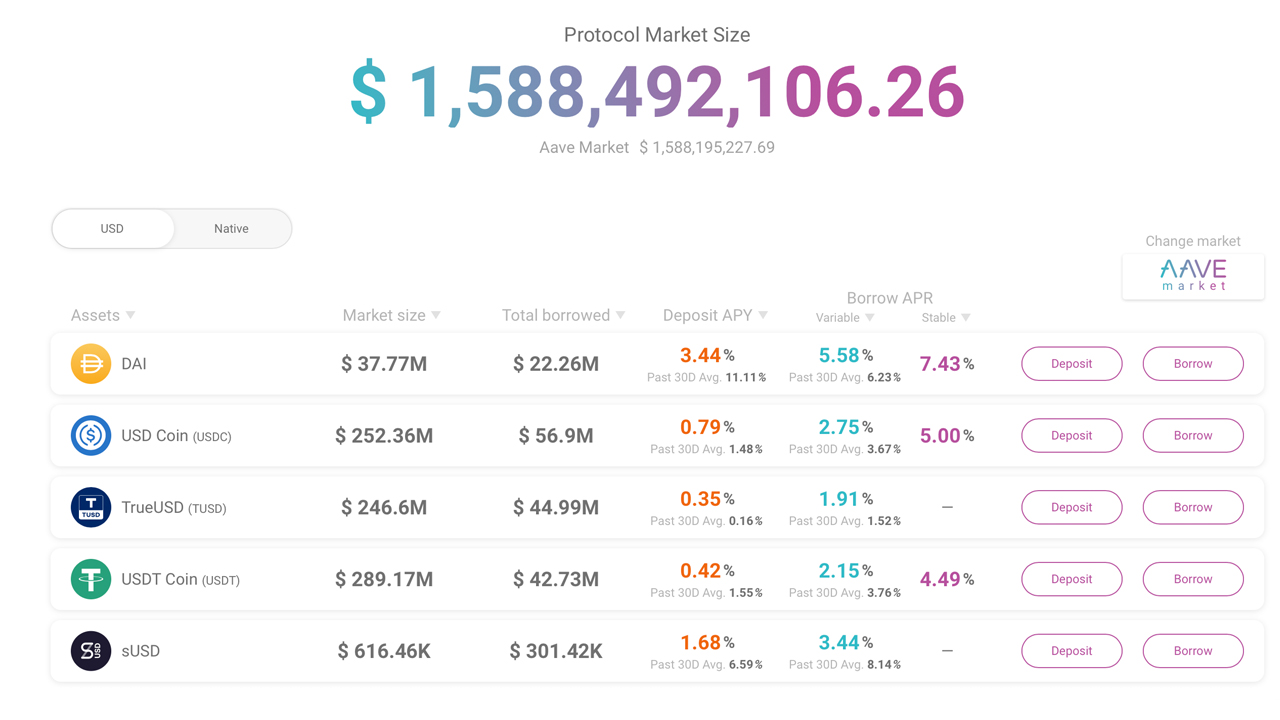

Basically, Aave (previously known as Ethlend) allows for decentralized lending and borrowing using a variety of cryptocurrencies while also leveraging variable and stable interest rates. Individuals also utilize Aave for flash loans, a loan that must be executed within a single Ethereum transaction.

Flash loans if executed properly can allow anyone to borrow liquidity from the Aave protocol and they don’t need to provide any collateral. As long as the liquidity is reimbursed within the one transaction in a single block, the loan will carry out as planned. Aave’s lending and borrowing protocol at times can remove the need for capital, which essentially lowers the barrier to entry.

In addition to the platform’s recent surge in popularity, Aave’s U.K. business entity, Aave Limited, was recently issued an Electronic Money Institution license. Documents show Aave was approved by the U.K. Financial Conduct Authority (FCA) on July 7, 2020.

Aave is also in the midst of transitioning to V2, a fully autonomous system called the “genesis governance.” The team believes that in time the project can encompass tokenized mortgages on the Ethereum blockchain. In a recent blog post Aave’s Marc Zeller hinted at the concept concerning tokenized real estate.

“The Aave Protocol will now allow the governance to open private markets to support tokenized assets of all kinds,” Zeller wrote. “A collaboration between Real-T and the Aave Protocol is in the works to push DeFi even further and bring mortgages on Ethereum.”

In addition to the FCA approval, Aave launched a website dedicated to its position as an Electronic Money Institution in the U.K. region. Flash loans have been a big part of Aave’s popularity and news.Bitcoin.com reported on how there’s been over $100 million a day in flash loans using the lending protocol.

Moreover, developers have created programs like Furucombo that combine all the defi applications together in order to execute combined actions within a single transaction. However, Furucombo’s website notes the program is beta software, and it “should be treated as highly unstable.”

What do you think about Aave’s TVL surpassing Maker and the project’s recent Electronic Money Institution license? Let us know what you think in the comments below.

The post Aave Protocol Outpaces Maker With $1.4B Locked, Defi Project Granted UK Electronic Money License appeared first on Bitcoin News.