It’s tempting to say 2021 was the year bitcoin finally went mainstream and just leave it at that. However, there’s another story that can’t be understated: the spectacular rise of altcoins or “alts” — that is, cryptocurrencies that are neither bitcoin nor ether — thanks in part to the NFT boom.

As the CoinDesk 2021 Annual Crypto Review showed, Bitcoin’s year played out like something unimaginable even three or four years ago: A sovereign nation (El Salvador) adopted it as legal tender and there was an upgrade to make it more transaction-friendly. Bitcoin traded close to $69,000 in 2021, and its market cap broke above $1 trillion at one point.

For reference, when CoinDesk began publishing in 2013, the total value of bitcoin was little more than $1 billion and each coin was trading around $120 or so.

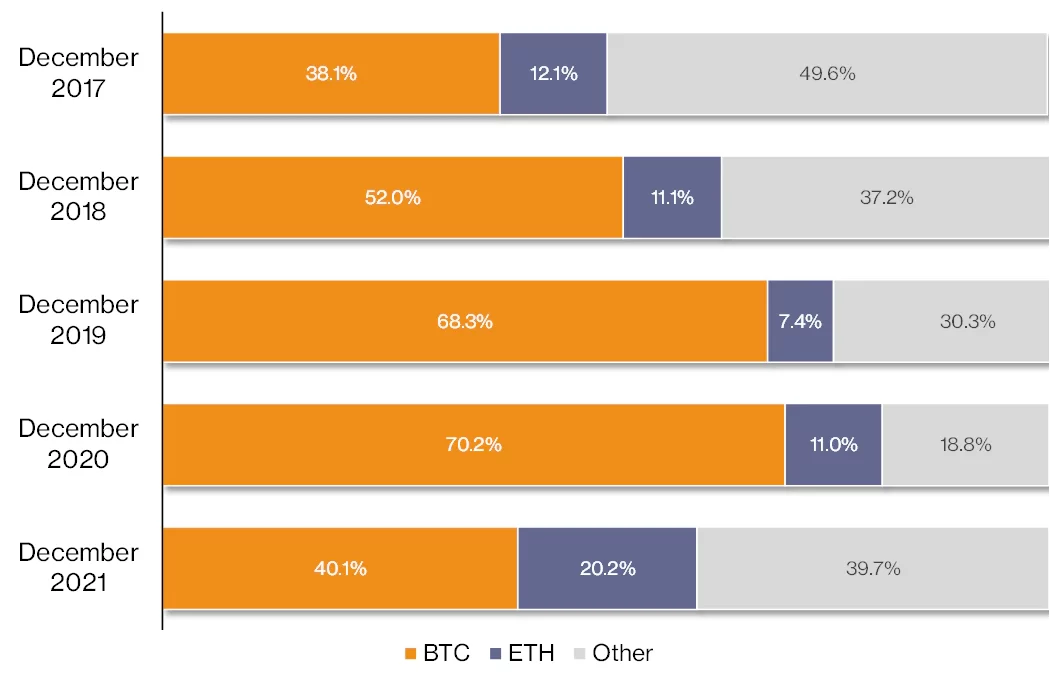

A notable feature is the decline of bitcoin dominance – meaning its share of overall crypto market cap – last year, from 70.2% to 40.1%.

But that doesn’t necessarily mean bitcoin has lost its luster. It just means there’s a lot more going on in crypto than just bitcoin these days.

To be sure, bitcoin added $330 billion in value in 2021 to close out at $875.9 billion, according to data from CoinMarketCap.

On the other hand, ether returned 426% to investors in 2021. Its year-end value was $438 billion, meaning the market essentially added even more value to ether – $355 billion – than it did to bitcoin.

Yet the big market value gains last year were in the combined capitalizations of all the other cryptocurrencies out there – the altcoins. Taken together, these thousands of cryptocurrencies closed 2021 valued at $934 billion, or 39.7% of the total market cap of the entire crypto complex. That year-end figure is a gain of $791 billion, or a 550% increase.

In other words, the market has decided that it likes bitcoin more than it did a year ago, but it really, really likes ether and the alts.

Drilling down a little bit and one can see the underlying theme of the alts was clearly the rise of the Layer 1s, meaning the native tokens of smart contract platforms that compete with Ethereum.

BNB, the native token of Binance Smart Chain, went from $5 billion to $85 billion, Solana’s SOL exploded from $85 million to $55 billion, and Cardano’s ADA took off from $5.5 billion to $46 billion (though it was at $95 billion over the summer). To be sure, a dramatic rise was to be found in Layer 2 protocols, too. Polygon, a supplemental network to Ethereum, saw its native token MATIC rise in value from just $91 million at the start of 2021 to $18 billion at year end.

Driving it all to a great degree is the exorbitant gas fees – the cost to conduct transactions on the blockchain – found in the Ethereum blockchain, according to George Kaloudis, research analyst at CoinDesk. He sees the potential to scale as the reason why Solana and Polygon in particular, gained so much last year.

“Gas fees were so high that it was difficult to carry out transactions on Ethereum. So, people started looking for cheaper alternatives,” which they found on Polygon and Solana, Kaloudis said on Thursday’s “First Mover” program on CoinDesk TV.

The demand for gas, in turn, came about because of the surge in interest in non-fungible tokens, limited-edition digital collectibles sold by artists and celebrities.

“A lot of the new use cases that are coming up are new Layer 1 smart contract platforms. They’re trying to scale these Layer 1s and make them cheaper and make them more affordable, make them more accessible. And really, that’s powering the NFT boom that we’ve seen the past year,” said Kaloudis. “A lot of people heard about Ethereum because of NFTs, not the other way around.”

Still, Kaloudis is most excited by the rise of the Lightning Network supplementing the Bitcoin blockchain. It allows for cheaper transactions using Bitcoin, which could ultimately make the currency more agreeable as a means of transaction. “That’s my favorite use case of the year,” he said.

The Lightning Network has grown to 3,300 BTC committed to it – double from June 2020 – thanks in part to El Salvador’s use of bitcoin as legal tender.

It remains to be seen if that will sway attention from the competition between Ethereum and other layer 1s when it comes to transactions.

Nonetheless, it makes for an amusing question – what if bitcoin becomes the altcoin of 2022?