The Chicago Mercantile Exchange (CME) has jumped to the No. 2 position on the list of the world’s biggest bitcoin futures exchanges by open interest.

This is notable because the exchange is seen as a proxy for institutional demand. Further, its latest jump from last month’s fourth spot is reminiscent of the exchange’s rise to the top seen during bitcoin’s four-fold institutional-driven rally to nearly $40,000 in the final three months of 2020.

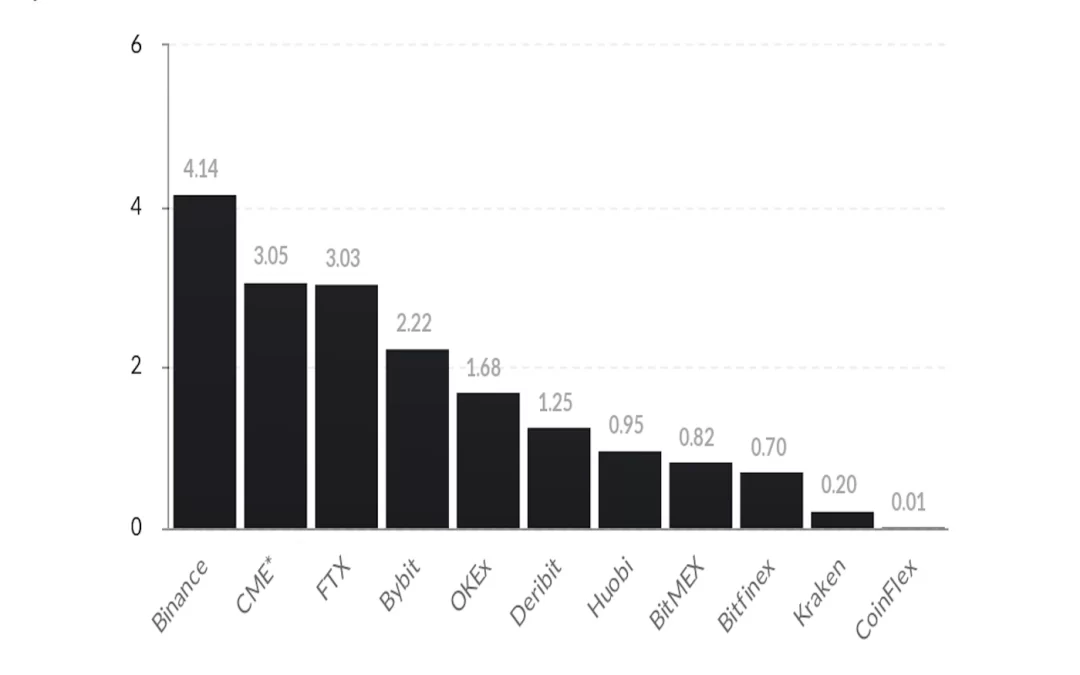

- The CME now accounts for nearly 17% or $3 billion of the global futures open interest of $17.9 billion, according to data provided by the derivatives research firm Skew.

- The CME is climbing ranks amid bitcoin’s price rally, as was the case a year ago. The cryptocurrency has rallied more than 30% to $54,000 since Sept. 29, decoupling from the weakness in stock markets. The derivatives giant rose to the second place in May, however, that was largely due to leverage washout or crash in open interest on other exchanges.

- The annualized premium or basis on CME’s front-month futures has climbed to a six-month high of 15% – also a sign of increased institutional participation.

- While CME has replaced FTX as the second-biggest exchange, Binance, which has come under the regulatory hammer in the past few months, retains the top spot, with an open interest of $4.1 billion. The CME dethroned Binance in late December 2020, but the latter quickly regained the top spot in the first quarter of this year.