Last week, SEC announced that some Initial Coin Offering (ICO) tokens could be considered securities. This means startups catering to US citizens would need to abide by current regulations and register with SEC. However, it appears that many firms may be ignoring SEC’s warnings. They may push forward with their token distribution events regardless of the rules.

Also read: Blockchain Education Network to Conduct Multi-City ‘Bitcoin Airdrop’

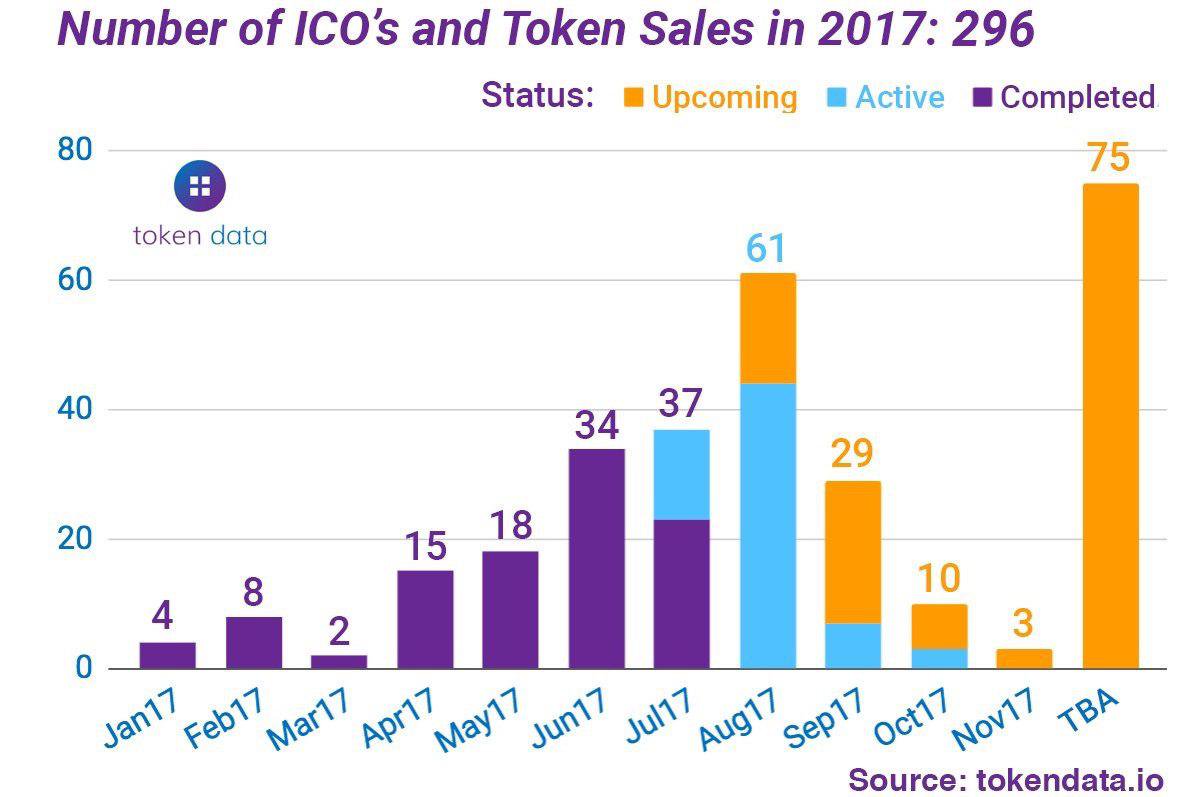

According to a tokendata.io, there are about 120 upcoming/active token distribution events for 2017 and roughly 20 announced since SEC issued its warning. A Tech Guam article covered the information:

Some industry participants and analysts had thought such a decision would have a chilling effect on the ICO market. But 20 new ICOs were announced since the SEC’s decision, with more than 120 scheduled to launch this year….

Several ICO’s are also about to begin their token distribution. These include, Groceryx, Corion, Eros, and many more.

SEC Requirements for Security-Based Tokens

According to SEC’s considerations on the matter, most of the aforesaid tokens may not fall into their regulatory framework. This means some tokens do not genuinely fit into the “securities” category. For instance, most crypto-tokens do not grant equity in a company. They also have limited disclosure requirements, according to the Tech Guam article.

These tokens actually have utility or use cases in order to bootstrap a project, whereas a  security represents ownership or stake in a particular company. An Investopedia article explained what a security is:

security represents ownership or stake in a particular company. An Investopedia article explained what a security is:

“A security is a fungible, negotiable financial instrument that holds some type of monetary value. It represents an ownership position in a publicly-traded corporation (via stock), a creditor relationship with a governmental body or a corporation (represented by owning that entity’s bond), or rights to ownership as represented by an option.”

Under this nomenclature, it appears few ICO’s will fall into the security category, but SEC may make their own mind whether the firm fits the criteria. Some entities advise that new startups call SEC and determine if their digital asset requires regulation. In either case, there does not seem to be any stopping the creation of new blockchain firms and their initial coin offering events.

Do you think SEC regulations will be able to halt ICO’s? Will decentralization keep the regulators at bay? Share your thoughts in the comments section below!

Images courtesy of Shutterstock and Tokendata.io

Do you agree with us that Bitcoin is the best invention since sliced bread? Thought so. That’s why we are building this online universe revolving around anything and everything Bitcoin. We have a store. And a forum. And a casino, a pool and real-time price statistics.