On May 11, 2020, the Bitcoin network completed it’s third block reward halving and the network seems to be chugging along just fine. However, it may take a while longer to see the halving’s effect on the mining industry and right now bitcoin transaction fees have risen exponentially. Despite the rising fees, the research firm Glassnode explains that the Bitcoin blockchain’s health “remains strong” after the reward reduction.

Despite the Rise in Bitcoin Transaction Fees, Glassnode Report Says Overall Network Health remains strong

The Bitcoin (BTC) network has halved its block reward and so far, everything is still working as intended, at least for now. One issue people are complaining about today is the fact that transaction fees have risen significantly since the halving. For instance, if one was to do a rough average of the 50 blocks mined before the halving, they would see that miners were getting around 0.205 BTC in transaction fees per block.

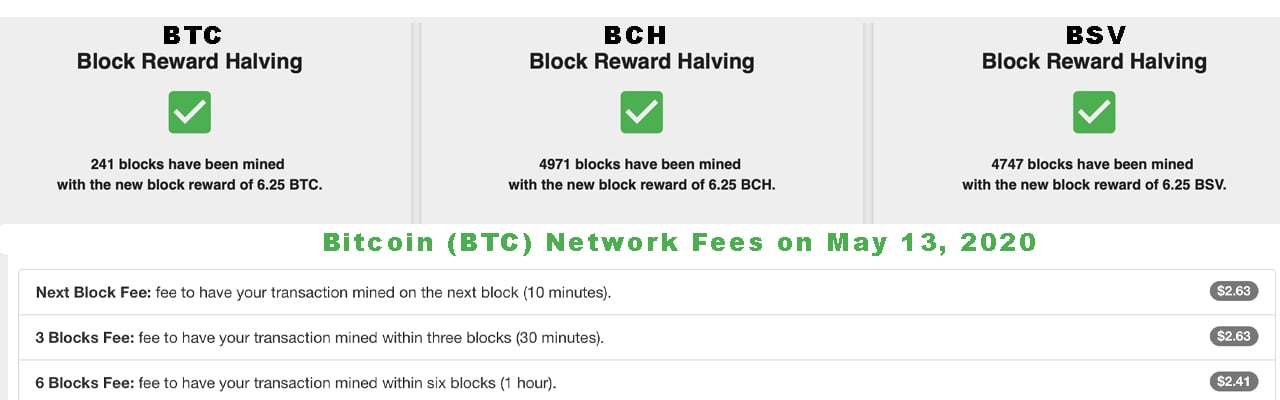

After the halving, however, and a little beforehand, the transaction (txn) fees started rising much higher. At the time of publication, the fee required to get into the next block can range between $2-4 per txn. 241 blocks have been mined so far after the halving, and miners are getting around 1 BTC in fees per block or a touch more or touch less per block. Meaning, most miners are getting around 7.5 to 8 BTC per block, which is not too bad of a loss especially with the price rising slowly.

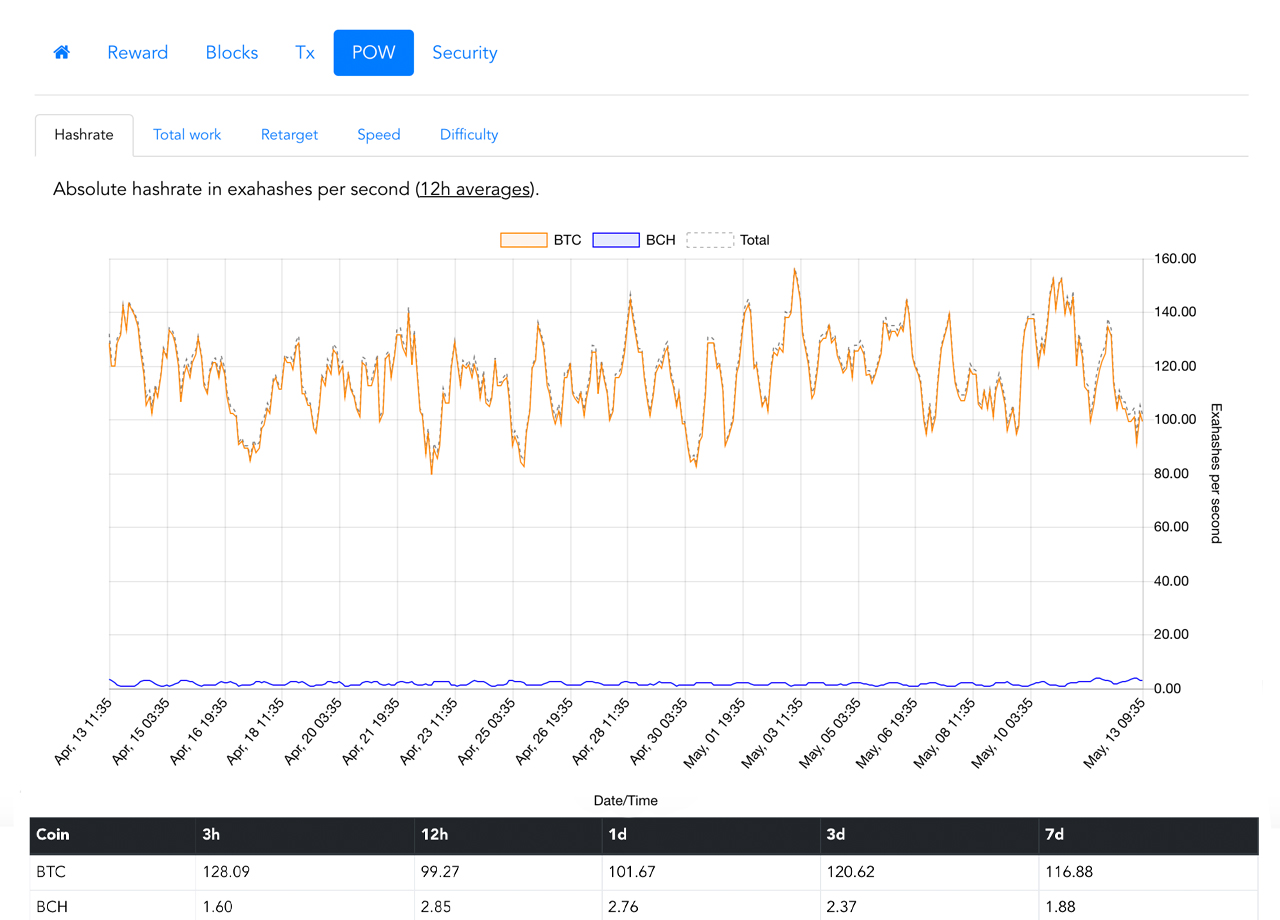

A recent report from the research and analysis firm Glassnode called “The Week Onchain: Week 19, 2020,” explains that the Bitcoin network is still in peak health performance-wise. Bitcoin fundamentals remained strong leading up to and following the halving,” Glassnode reported. “Hashrate follows its trajectory as miners keep mining,” the report added. As far as BTC’s market health is concerned “onchain fundamentals dropped slightly in Week 19,” Glassnode said. “GNI registered a 2 point decrease over the week, pushing its overall assessment of the Bitcoin ecosystem to 74 points, the 10th highest weekly value since 2017. This downturn was mainly driven by the Sentiment subindex, which decreased by 13 points,” the company wrote. Glassnode further continued:

Network Health improved through solid gains in both Network Growth and Network Activity, the former reaching the highest possible value for the first time since 2017. Liquidity has seen marginal improvement over the last few weeks after registering increases in Transaction Liquidity and slight decreases in Trading Liquidity. After staying close to the 50 point mark for 5 weeks, it has now worked its way up by 9 points. In the lead up to Bitcoin’s third halving, Sentiment, on the other hand, has begun to drop sharply. Despite this, however, overall network health remains strong.

Coinshares CEO: ‘Bitcoin Is the Perfect Hedge for Any Investor’

Additionally, many BTC investors and cryptocurrency company executives are still very optimistic about bitcoin’s next rise. Jean-Marie Mognetti, CEO of Coinshares, detailed in a note to investors that with “the courage of [his] conviction, [he is] bullish for bitcoin.”

“Meanwhile, the Fed is trying to keep the market sentiment positive and has extended its balance sheet by about 2.6 trillion dollars since the end of February,” Mognetti wrote. “This is the biggest monetary inflation ever witnessed and the market is expecting more fiscal stimulus and bond-buying programs to be issued. This is somehow already priced in with Fed fund futures for mid-2021 and end of 2021 price implying negative Fed rates. This is a first for the US, but we are in a time of “firsts”. Oil was also not supposed to be able to trade in negative territory,” the Coinshares CEO added. Mognetti concluded by stating:

The rest of the world needs to either keep printing money or see their own currency eroding drastically in front of the unbeatable dollars. Turkey, Brazil, or Argentina are the perfect examples of this. Consequently, in a world where investors continue to seek protection for their portfolios against the world’s Central Bank’s behavior, bitcoin, a digital currency whose supply is programmatically defined to reduce until it reaches its maximum supply, would seem to be the perfect hedge for any institutional investor’s portfolio.

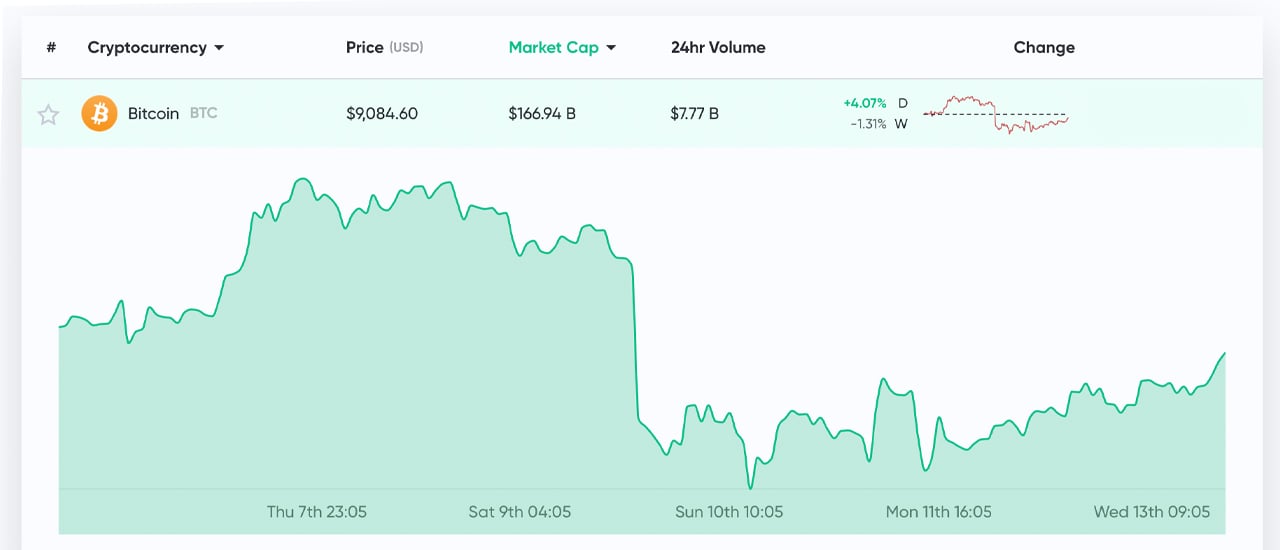

At the time of publication, BTC has crossed the $9K price region once again after going below $9K just before the halving. The cryptocurrency has a market capitalization of around $166 billion today and the network hashrate was unaffected by the halving. Although data from the web portal Fork.lol shows that BTC may have lost around 15-20 exahash in the last 24 hours. If the price per BTC, continues to rise however, then those miners could easily return in the near future. If the price goes southbound, BTC network observers may see a much larger capitulation of miners leaving. So far, with more than 24 hours behind the halving and 241 blocks mined that doesn’t seem to be the case.

What do you think about the day and a half after the Bitcoin Halving? Let us know in the comments below.

The post 2 Days After the Bitcoin Halving: Network ‘Remains Strong,’ Higher Fees, Bullish Sentiment appeared first on Bitcoin News.