Coinbase has raised $100 million in Series D funding in what is the largest single traditional funding round for a public blockchain or cryptocurrency startup, according to CoinDesk data.

Announced today, the round was led by Institutional Venture Partners (IVP), a Silicon Valley venture firm that counts some of the biggest tech and digital startups, including Dropbox, GitHub and Netflix, among its portfolio. Also participating are Battery Ventures, Draper Associates, Greylock Partners, Section 32 and Spark Capital.

The round’s completion raises Coinbase’s collective funding to date to more than $217 million, higher than any other industry firm that has raised money from accredited investors.

Put in context, cryptocurrency and distributed ledger startups have raised a combined $1.9 billion to date, meaning Coinbase now accounts for 10% of all venture capital invested in blockchain startups.

In statements, Coinbase said that it would use the funds to expand its customer support and engineering teams, a statement that follows previous commitments to growing support amid a wave of diversifying customer complaints.

Numbers game

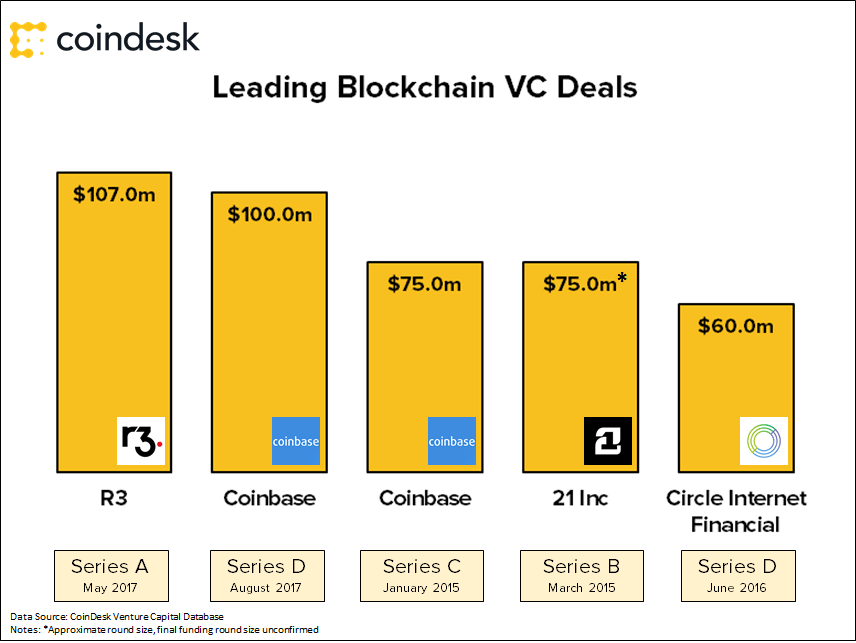

Taking another look at the data, Coinbase has now raised two of the industry’s largest funding rounds since it was founded in June 2012 and incubated by Y Combinator.

Most recently, Coinbase completed a Series C funding round in early 2015, netting $75 million from a group of investors that included the New York Stock Exchange and Fortune 500 financial services group USAA. In between, it also raised $10.5 million from Mitsubishi UFJ.

In context, however, it is the Series C and Series D rounds that stand out as among the industry’s largest.

Still, Coinbase’s $100 million round is notably less than the $107 million raised by distributed ledger startup R3 as part of its Series A round revealed in May. Notably, that figure is expected to climb with the addition of a third tranche of capital yet to be closed.

While widely reported in excess of $110 million, fellow Andreessen Horowitz portfolio firm 21 Inc likely never raised this funding in a single round. Investor materials obtained by CoinDesk indicate it was raising a $75 million Series C in early 2015.

The idea that the funding was raised over time, in smaller rounds, is also backed by reporting by author Nathaniel Popper, who reports a smaller $25 million round was never publicly disclosed.

ICO blues

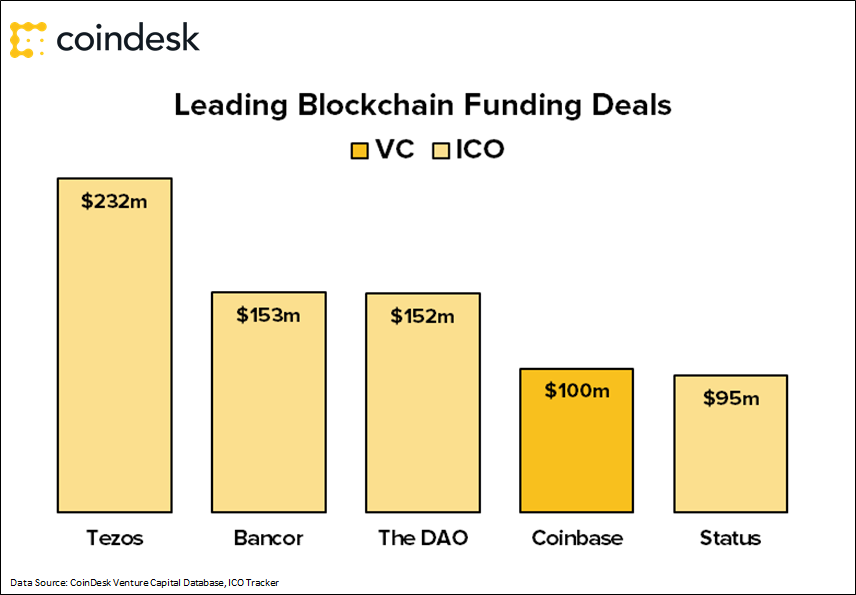

Put in another context, however, Coinbase’s funding is lower than three other open-source blockchain projects.

According to the CoinDesk ICO Tracker, blockchain projects have raised more than $1.6 billion by selling cryptographic data designed to power their protocols through a funding method known as an initial coin offering (ICO) or token sale.

And while it’s not exactly an apples-to-apples comparison (ICOs are a new and poorly understood funding mechanism), showing the Coinbase raise in context does serve to show potential of that market.

It also highlights its potential excess.

While Coinbase has been active for years, has hundreds of employees and boasts $25 billion in user trading volume on its exchange product GDAX, many ICO products have raised more from investors with little more than a white paper and highly criticized code.

Still, with more traditional VCs showing a willingness to investor in ICOs and tokens, the metric will likely be one to watch as it sheds light the ongoing changes in the blockchain funding sector.

Disclosure: CoinDesk is a subsidiary of Digital Currency Group, which has an ownership stake in Coinbase.

Coinbase headquarters via CoinDesk archives; Charts by Alex Sunnarborg

The leader in blockchain news, CoinDesk is an independent media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. Have breaking news or a story tip to send to our journalists? Contact us at [email protected].